The District ended 2017 with $434.1 million of reserves in its Unemployment Insurance Trust Fund. This is the highest level of reserves the city ever accumulated; and it is equivalent to 3.8 times the benefits paid out in the same year.

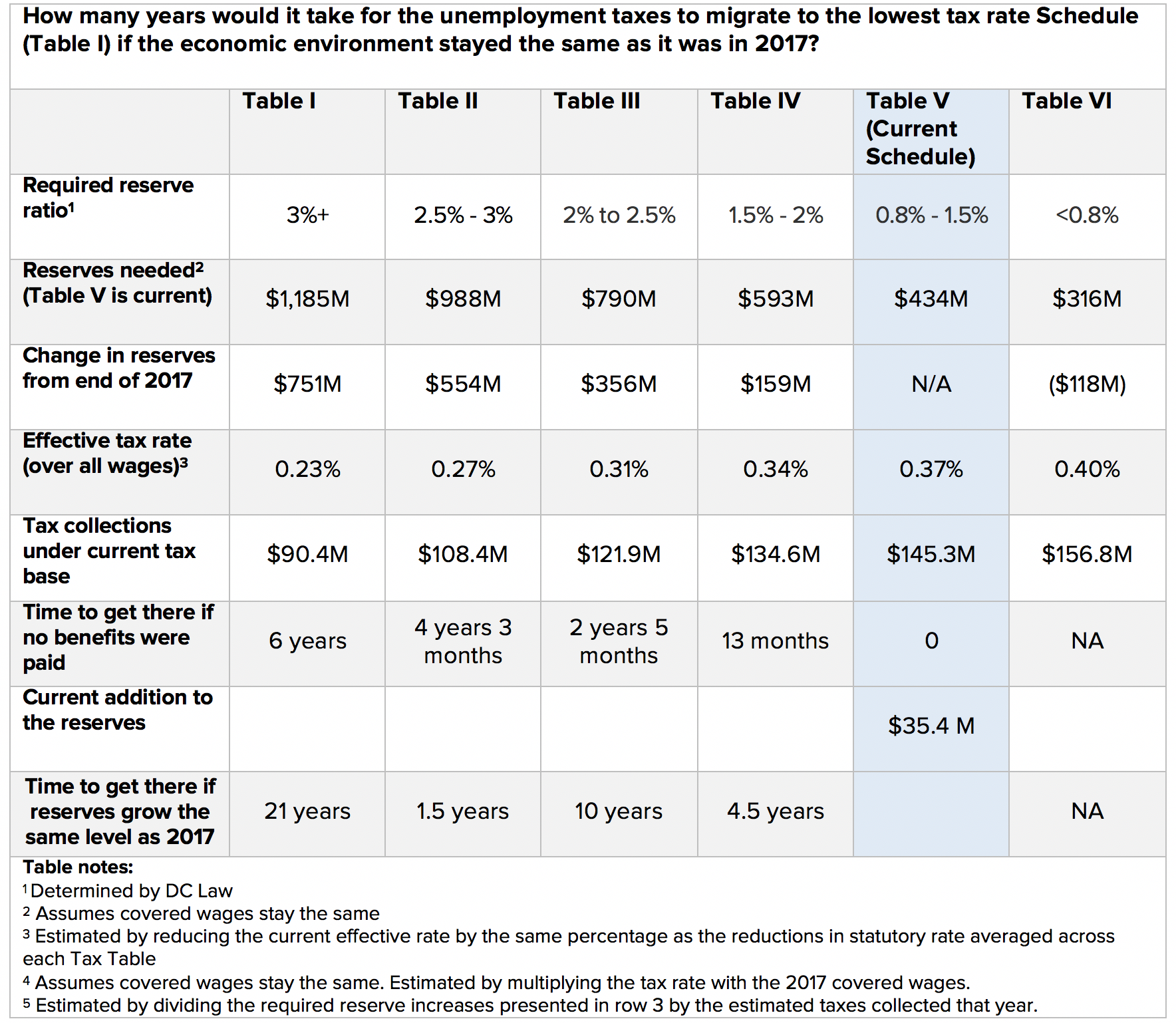

Despite this large reserve, tax rates, which should decline as reserves increase, are not likely to go down any time soon. Under the District’s unemployment laws, the District must add another $150 million to its trust fund reserves before moving to a lower tax regime (if economic conditions stay the same).[1] That is, employers would not see a tax cut until the reserves are more than five times the benefits paid out in 2017.

A healthy reserve is important for the viability of the District’s unemployment compensation program. Economic conditions do change, and if they deteriorate fast enough, the program would have to rely on its reserves to remain solvent. But when reserves are higher than necessary, there are potentially hundreds of millions of dollars that neither businesses nor the D.C. Government can use for anything else—they are simply removed from the local economy, a complete deadweight loss.

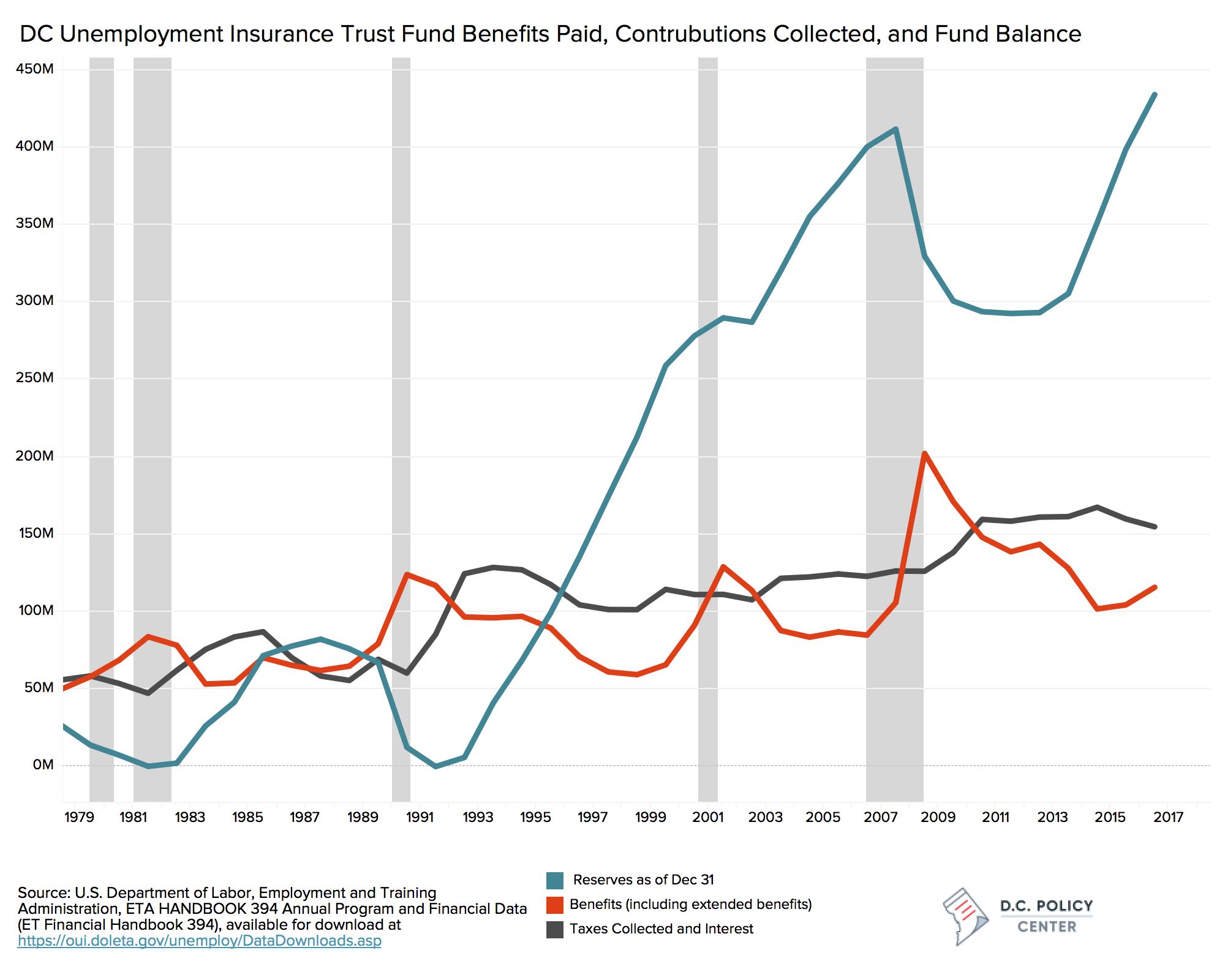

The District did not always have a robust unemployment trust fund. Prior to 1993, the fund was perpetually weak, undermined by an imbalanced benefit-tax structure and dismal management. The trust fund was bankrupt for a decade between 1975 and 1984, and never really fully recovered in the following years, and went bankrupt again in 1991.

Beginning 1993, the District adopted a series of significant reforms that increased taxes, reduced benefits, and made the tax rate adjustments in response to reserve improvements much more conservative. The result is the current system, which is decidedly strong, but with a high opportunity cost. This could be changed by tweaking the current tax structure.

There are, however, two impediments to reforming the unemployment insurance tax structure.

The first is the solvency evaluations from the U.S. Department of Labor, which show, despite its massive reserves, the District’s Unemployment Insurance Trust Fund is barely solvent. In what follows, I show that the Department of Labor solvency calculations are not appropriate metrics of solvency for the District of Columbia. I also offer a way the District can correctly measure its Trust Fund solvency.

The second impediment is a strong alternative to today’s system. Unemployment compensation is complex, and any changes to it must be put through a robust stress test. The Department of Labor’s State Benefit Financing Model—a simulation model that projects the impact of policy changes on taxes and reserves under different economic conditions—can help run these tests. The District’s own Department of Employment Services has the necessary data to provide the model with the correct ingredients. The District should take advantage of these resources and test alternative tax models to find a system that is less burdensome on its economy. With payroll taxes due to increase as the District begins to implement its paid family leave laws, reforming the unemployment tax is even more urgent, and will be a welcome relief to all businesses, especially those with lower-waged employees.

The final consideration is policy. The District recently changed its law on how unemployment compensation can be modified. The Director of the Department of Employment Services must now recommend a benefit increase every September, which is automatically adopted unless the Council passes a disapproval resolution reversing the recommendation. Since this change, the Director has made one recommendation for increasing the maximum weekly benefit from $425 to $437 in 2017, and the Council went with it. However, there was little information on how this increase would affect tax rates and the reserve ratio.

The law also the Director of the Department of Employment Services to consider the implications on trust fund solvency before recommending an increase.[2] The law, however, is silent on tax implications of a benefit increase, which is troublesome. At what cost? The size of the reserves does not tell us: Because of the way the unemployment insurance program is designed, tax increases will eventually follow the benefit increases to preserve solvency.

Unlike agency rulings or legislation, recommendations have no formal public comment or hearing process. This should change. Decisions on unemployment taxes and benefits should involve the stakeholders. Ideally, any benefit change (especially if it is beyond any reasonable cost-of-living increase) should be adopted by legislation, so it can have a hearing where the public and the public officials can testify. All costs, including the costs on the DC government should be specified. The Department of Employment Services should release to the public its analysis the proposed benefit increase, including the impacts on the reserves, the tax tables, and effective tax rate. At a minimum, the proposed benefit increase should be adopted by rule-making, which allows for a period when the public can examine these impacts and provide comments.

The District of Columbia’s unemployment compensation program is one of the most resilient in the nation

By the end of 2009, six months after the Great Recession ended according to the National Bureau of Economic Research, 35 state programs had exhausted their reserves and had to borrow from the federal government to meet their unemployment benefit obligations.[3] In the same year, the District had $329 million in the bank.[4] It was not the largest reserve in the nation—not surprising, given the District’s size—but it was among the programs with the most robust reserves [5]: DC had in hand $9,620 for each initial claim filed in 2009 (the maximum benefit payable that year was $9,256) and $470 per each week of benefits paid (the average weekly benefit was $303). The following year, when unemployment benefits paid to DC workers who lost their jobs to the recession skyrocketed from $106 million to $203 million, the reserves, at $340 million that year, still could pay for these benefits 1.6 times.

In 2011, when the Great Recession’s impacts had been fully realized on the state unemployment programs, the District’s own reserves had dipped to their lowest–$293 million–but were showing signs of recovery. With a stronger economy, unemployment and benefit payments had declined. The District had enough reserves to pay for the requisite unemployment benefits ($148 million that year) for two straight years, without relying on any tax revenue (which was also $148 m that year).

The Unemployment Insurance Trust Fund should have reserves strong enough support unemployment benefits during economic downturns

Unemployment insurance works like any other insurance—it pools idiosyncratic, business-specific risksacross many employers. At any given time, all employers pay unemployment taxes but only a small portion of them have workers who lose their jobs through no fault of their own and become eligible for unemployment benefits. The tax payments from many are combined to pay for the benefits for the few.

Unemployment taxes are like insurance premiums that increase with riskier behavior. Tax rates start high for all new employers until they establish a history that records tax contributions against benefits payments. In DC, this is three years. During that time, if the employer manages to hold on to largely the same workers, the employer’s reserves will go up and the unemployment tax rate for that business will go down. If, however, that business lays off too many workers, benefits will eat into the tax contributions reducing reserves, and the tax rates go up.

There are also systemic risks that affect everyone the same way and spoil this risk diversification. Economic downturns force all employers to cut back jobs. The benefits paid out of the fund increase because workers everywhere experience unemployment more frequently and for longer periods. Benefit durations and eligibility could also expand by federal policy during recessions,[6] further increasing benefits paid. At the same time, tax contributions decline because with fewer employees, the tax base – first $9,000 of wages paid to each employee in DC – declines. And if the downturn is bad, the taxes collected might not be enough to cover the benefits. The reserves make up the difference.

At the end of the recession, as the economy improves, and job numbers rebound, benefits start declining again. Unemployment taxes increase, putting a positive pressure on contributions, and the improving economy reduces the amounts paid out as benefits.

The reserve ratio acts as a thermostat, automatically adjusting tax rates to ensure reserve levels remain adequate.

Employers participating in the unemployment insurance program pay a tax rate based on two factors.

First is their individual “reserve ratio” that reflects an employer’s own history of taxes paid and benefits collected. States’ rules about how this ratio is calculated and related to a tax rate vary as each state has a different taxable wage and offer different unemployment benefits. In DC, taxes are levied on the first $9,000 of wages paid to an employee. In Virginia, for example, the tax base is $8,000.

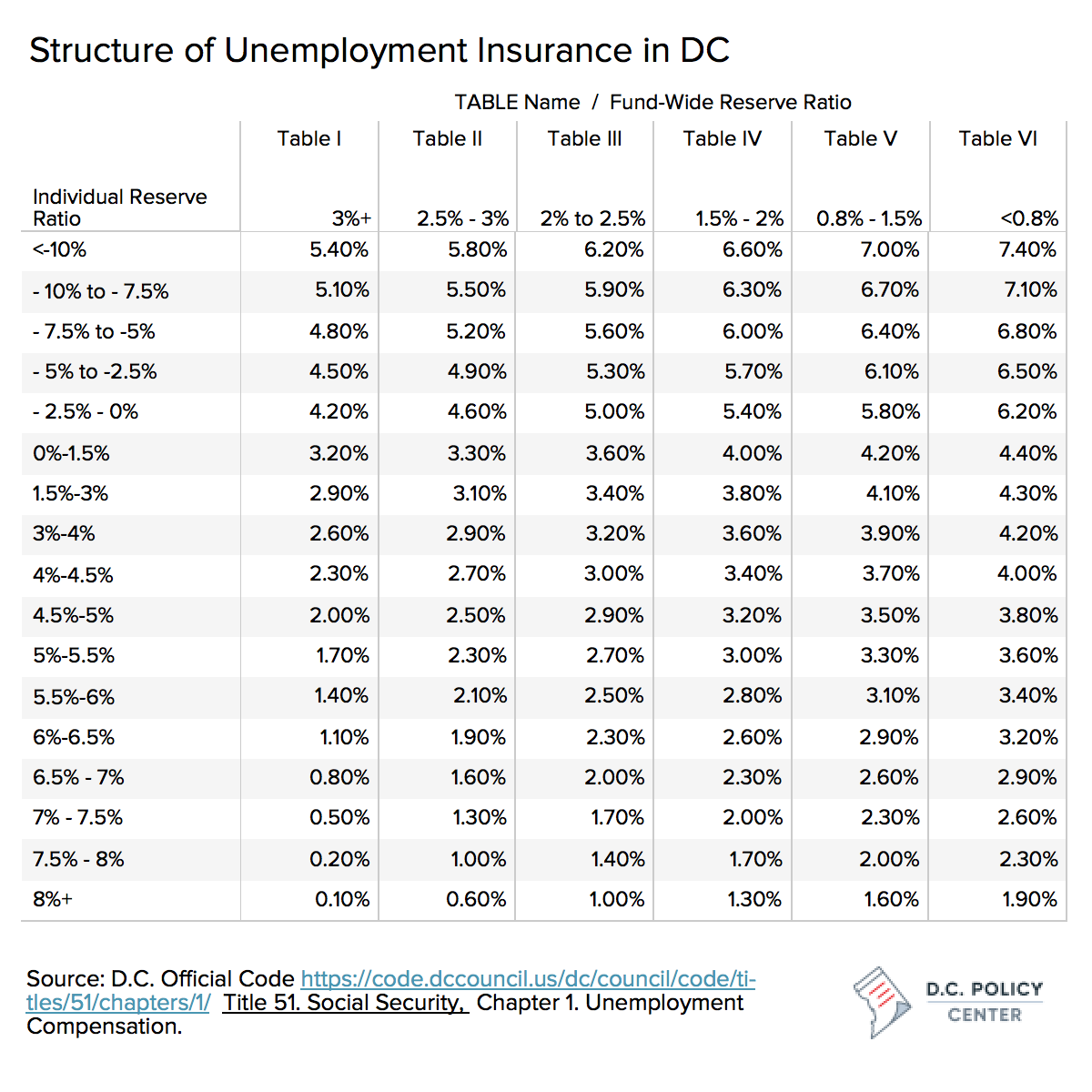

In DC, tax rates are lowest for employers whose reserve ratios exceed 8 percent. This means the amount of taxes these employers paid, net of the benefits their former workers received, is greater than 8 percent of the salaries of all current, benefit-eligible employees. Such a business will pay a tax rate under 2 percent no matter how bad the economic conditions are and could theoretically pay as low as 0.10 percent. In comparison, a business with no reserves could pay a rate between 3.2 percent and 4.4 percent and a business with negative reserves (those that paid less in taxes than benefits collected) could pay as high as 7.4 percent. In the table below, you can follow this by comparing the tax rates down each column.

Tax rates also change when the entire system becomes weaker or stronger. This is measured by the total reserves across the entire trust fund relative to the total wages of all employees covered in the program. The higher the reserves, the lower the tax rate for every employer, regardless of their individual reserve ratio. In the table above, you can track this by moving your eyes across rows. For example, the tax schedule called “Tax Table I” with the lowest tax rates for all would be in effect in DC when the overall reserves exceed 3 percent of all covered wages. At present, the District’s reserve ratio is 1.10 percent, putting in effect the tax rates specified in Table V.

Thus, the reserve ratios—for the entire fund and for individual employers—work like a thermostat, increasing taxes when the individual or systemwide balances are too low, and decreasing them when they are too high.

The District’s unemployment tax thermostat is not sensitive to improvements in the economy

The District’s unemployment taxes are not particularly sensitive to the improvements in the economy or the improvements in the fiscal strength of the Unemployment Insurance Trust Fund. Even when reserves go up, tax rates change very little.

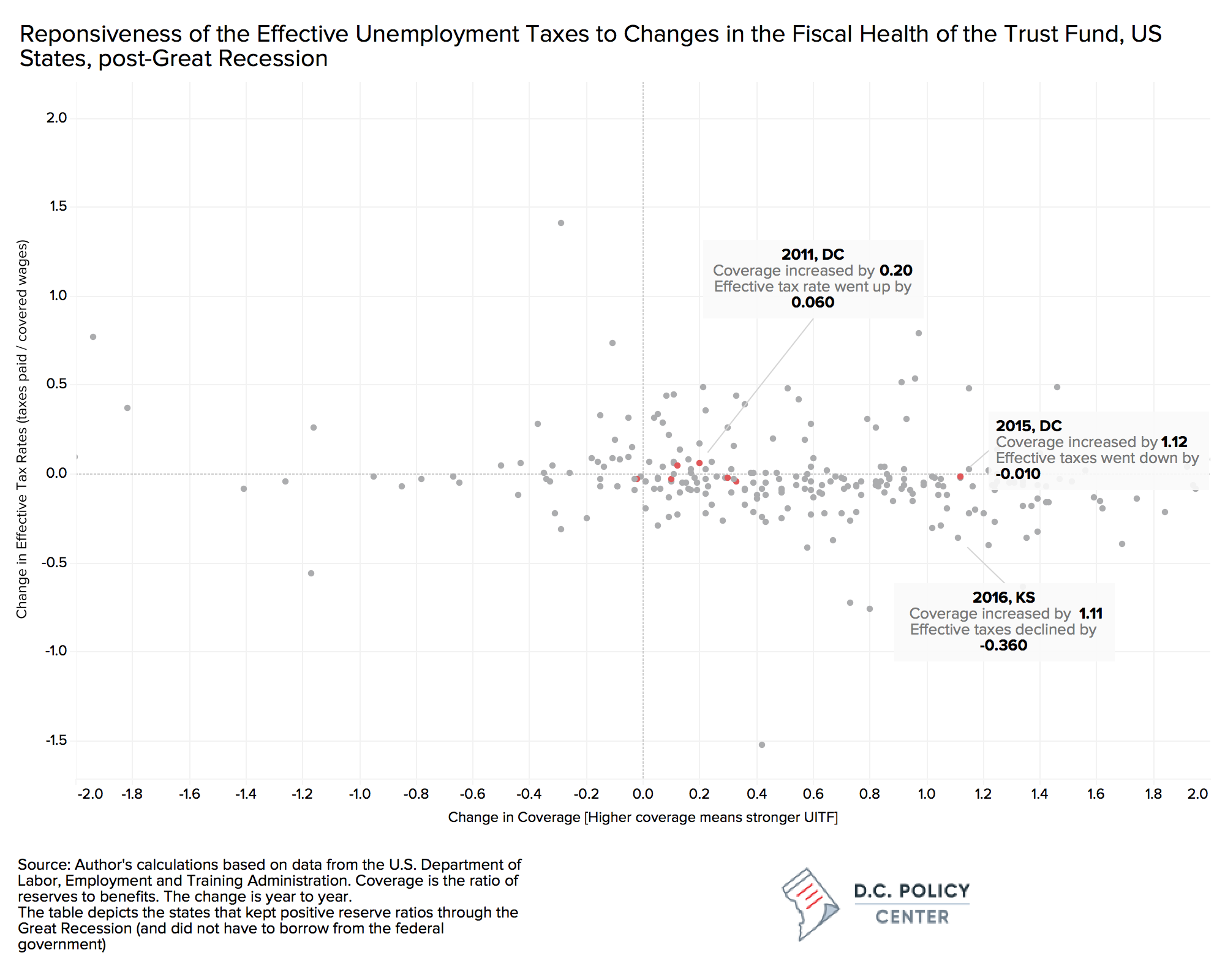

In the year’s following the Great Recession, the District’s tax rates have not declined as fast as other states’ when its Trust Fund got stronger. To see this, compare the benefits paid in a year to the reserves on hand. We call this coverage, as it captures how much of the benefits the existing reserves can cover even if the system had no additional tax collections in that year. (The Department of Labor calls this the benefit cost rate.) The chart below shows how the effective tax rates has changed in states since 2009 when the coverage—the reserve to benefit ratio—increased. Each dot represents one year and one state. DC’s dots are colored red.

All the dots in the two right-side quadrants represent states with growing reserves and stronger coverage rates.[7] For example, in 2016, Kansas saw its coverage increase by 1.11 – a very large jump as it means the reserves in hand increased by 1.11 times the total amount of benefits paid that year—and its effective tax rates declined by 0.36 percent. When DC’s Trust Fund improved similarly in 2012 (1.12 points), the effective taxes declined by 0.01 percent. You can observe this in the chart by noting that no matter how great the changes in coverage are, the District’s tax rate changes never steer too far away from the horizontal zero line.

Here is another way to look at this: Under the current system, DC would have to accumulate $1.1 billion in reservesbefore it could move from its current tax schedule (Tax Table V) to the lowest tax schedule (Tax Table I). This would mean increasing the reserves by $751 million. If we ever get there, under current conditions, the effective tax rates will only go down by an estimated 0.14 percent. And under the current conditions, it will take us six years to reach this reserve ratio if no benefits were paid between now and then. If we did pay benefits similar to what we paid in 2017, adding $35 million to reserves as we did that year, we would have to wait 21 years to get to that most favorable tax table. In other words, the lower tax tables bands in our unemployment tax statute is essentially irrelevant, as we are very unlikely to ever reach them.

The District’s current unemployment compensation system was created as a response to a Trust Fund that had remained insolvent for a decade

Our unemployment tax system exists in its current, overly cautious state because of how bad things were in the past. The District’s Unemployment Trust Fund went bankrupt first in 1975 following the 1973-75 recession and remained insolvent through 1984. During those 10 years of insolvency, the District borrowed over $530 million from the federal government (over $1.2 billion in today’s prices) to meet its unemployment obligations. The fund recovered briefly after that, but went bankrupt again during the next recession, in 1991. The District had to institute an additional “solvency tax” to restore a positive balance, but the benefits were too high relative to the taxes to make this a longer-term fix.

In 1992, the D.C. Government worked closely with the U.S. Department of Labor and the business community to adopt a different tax and benefit schedule, so the system would remain solvent even through tough economic times. Adopted in 1993, this legislation put in place the tax tables we use today; increased the taxable base from $8,000 to $9,000 of wages earned in a year; reduced the maximum weekly benefits from 55 percent to 50 percent of the District’s average weekly wage for all recipients; and further, reduced benefits for each recipient to 1/26th of their earnings in the quarter they earned the most (from 1/23rd). It also proposed a system of raising the taxable wage if the reserves stayed under $40 million (roughly $70 million in today’s dollars).

But this was not all. In 1998, the law changed once again to further lower benefits and eliminate dependent’s allowance, and in 2004 to offset benefits by the amount of pension income. The same year, the maximum weekly benefit was set at $356, and the District did notincrease this again until 2010 to $379. The weekly benefit is now set at $432.

Despite the strong reserves and a very conservative unemployment compensation program, the U.S. Department of Labor evaluates the DC’s Trust Fund as barely solvent

Every year, the U.S. Department of Labor publishes a report evaluating states’ Unemployment Insurance Trust Fund solvency levels. According to these reports, DC’s Unemployment Insurance Trust Fund was barely solvent at the end of 2017 (scoring 1.08 compared to the required solvency rate of 1), and not solvent at the end of 2015, 2014, or 2013 (scoring 0.98, 0.89, and 0.90 respectively). How is that possible?

There are no federal requirements for the amount of funds that should be kept in a state’s trust fund, but maintaining solvency enables states to keep the federal unemployment tax (FUTA) low. It also allows states to borrow interest-free from the federal government for a brief period (borrow and pay back within the same fiscal year) if their trust fund unexpectedly goes into the red. The Feds will offer this free money to states that have generally maintained a healthy trust fund. The federal criteria for health require that states, in at least one of the five previous years, kept their unemployment trust fund reserves above 90 percent of the benefits paid, all adjusted by the wages paid.[8] The District has met this eligibility criteria through the Great Recession and every year after.

The solvency reports use stricter criteria. The Department of Labor’s solvency metric is strict, in the sense that it fully ignores any inflow of unemployment taxes and compares benefits to reserves only. The Department of Labor’s evaluation is focused on how solvent a trust fund might be if the economy went into a recession. So, the researchers look for the years with highest benefit payments (and therefore worst employment outcomes). They look back on the past 20 years or the period that includes the last three recessions, whichever is longer. (At present, this takes us back to 1991, since there were only two recessions in the last 20 years.) Then, they identify the three years when benefits paid out as a percentage of total wages of all employees covered by unemployment insurance [9]—which they call the high-cost rate—was highest. They take the average of these three years (which they call average high-cost rate), and then compare it to the current reserves as a share of the wage base. If this ratio—which they call the high-cost multiple—is greater than 1, they deem the trust fund solvent. This calculation is similar in concept to the coverage rate we discussed before, but it compares today’s reserves to the highest benefits paid in the look-back period.

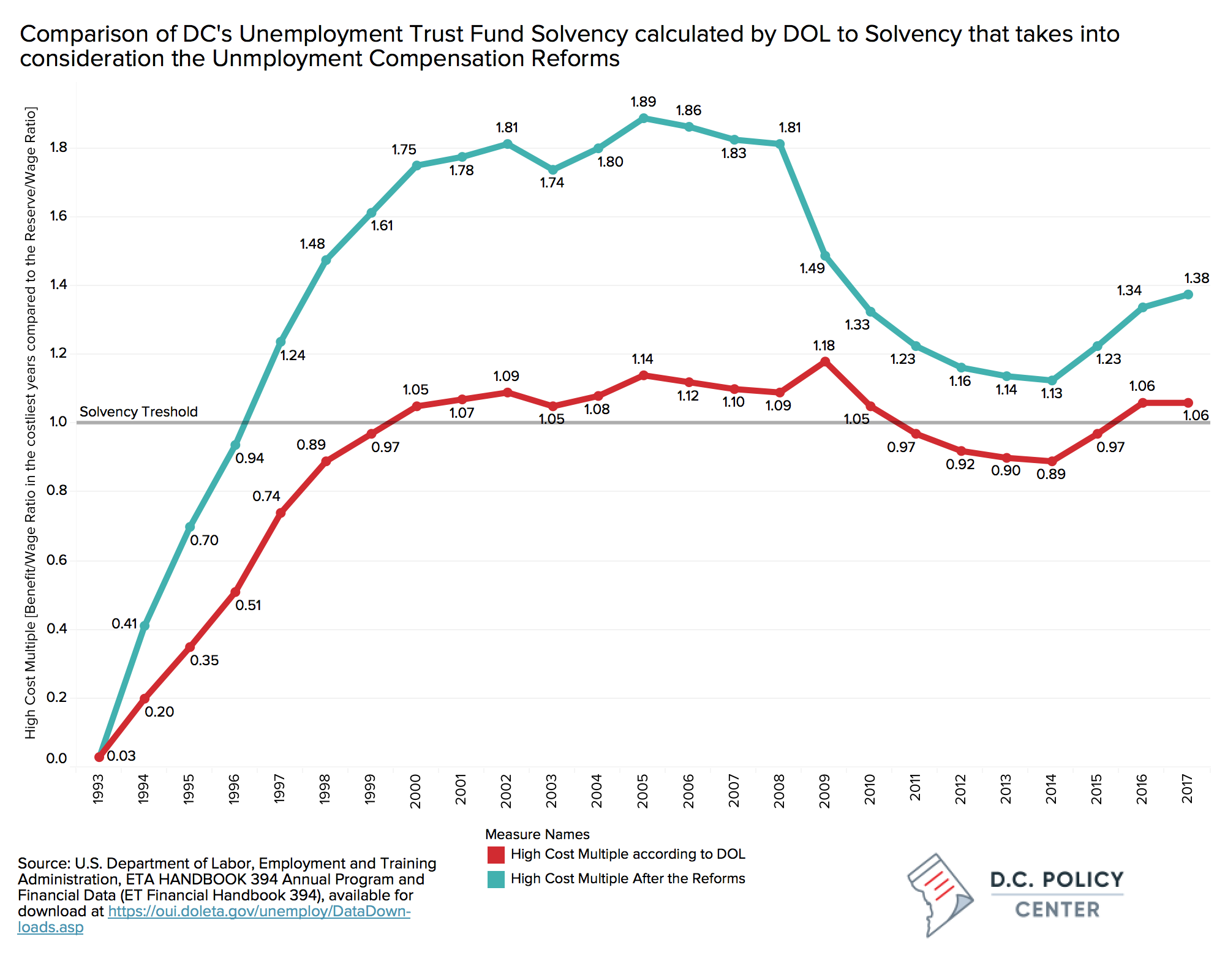

Following this method, one would find that the District’s Trust Fund did not become (strictly) solvent until 2000, and fell into insolvency in 2011, and did not emerge from it until 2016 (red line in the chart below). How could this be as we ended the Great Recession with a reserve amount higher than benefits paid in the worst year of the recession?

For the District of Columbia, the Department of Labor’s high cost rate years are 1991, 1992, and 1993. These years are in their look-back period, but for DC, they belong to an entirely different era. All three high-cost years the Department of Labor uses are before the District’s major unemployment compensation reform (1993), which reduced the benefits paid and adopted a conservative tax regime. Because our system looks nothing like what it was before 1994, Department of Labor’s high-cost years are irrelevant, and produce strict solvency metrics that are not appropriate.

To wit, in two of Department of Labor’s worst performing years, the Trust Fund was bankrupt (1991 and 1992); in the third year (1993), the benefits paid was 85 percent of the reserves in hand. The District never experienced such a high cost rate since then. During the worst of the Great Recession, the benefits paid increased only to 77 percent of the reserves in hand.

The solvency calculations should focus on the performance of the city after it reformed its unemployment compensation system.

We calculated an alternative strict solvency measure for the District, limiting our look-back period to the years after the District adopted its Unemployment Compensation Reform. Under this alternative (shown as the blue line in the chart), the high cost years for 2017 are 1993 (at the very beginning of the look back period, and still largely reflecting weaknesses of the old regime), 2002 ( after the 2001 recession, when benefits equaled 78 percent of reserves) and 2009 (again, following a recession, with benefits 77 percent of reserves). These three high cost years, when averaged, produce a high cost rate of 0.80. Comparing this metric to the reserves in hand, we calculate that the District’s reserves equal 1.38 times in 2017—again, not relying on any tax contributions—if we had a recession that looked like the average of the three worst years in our post-reform period. In our solvency measure, the District’s Trust Fund turned solvent in 1995, and remained that way since then.

This measure makes more sense because it reflects the features of our reformed system. For example, at the end of the Great Recession, the District still had $293 million on hand in reserves. We think that if the recession continued with the same force into 2014, given these reserves, we could have paid for benefits for another year and some more (Strict Solvency = 1.13). But the DOL declared the fund insolvent that year, despite the high reserves (Strict Solvency =0.89).

This measure makes more sense because it reflects the features of our reformed system. For example, at the end of the Great Recession, the District still had $293 million on hand in reserves. We think that if the recession continued with the same force into 2014, given these reserves, we could have paid for benefits for another year and some more (Strict Solvency = 1.13). But the DOL declared the fund insolvent that year, despite the high reserves (Strict Solvency =0.89).

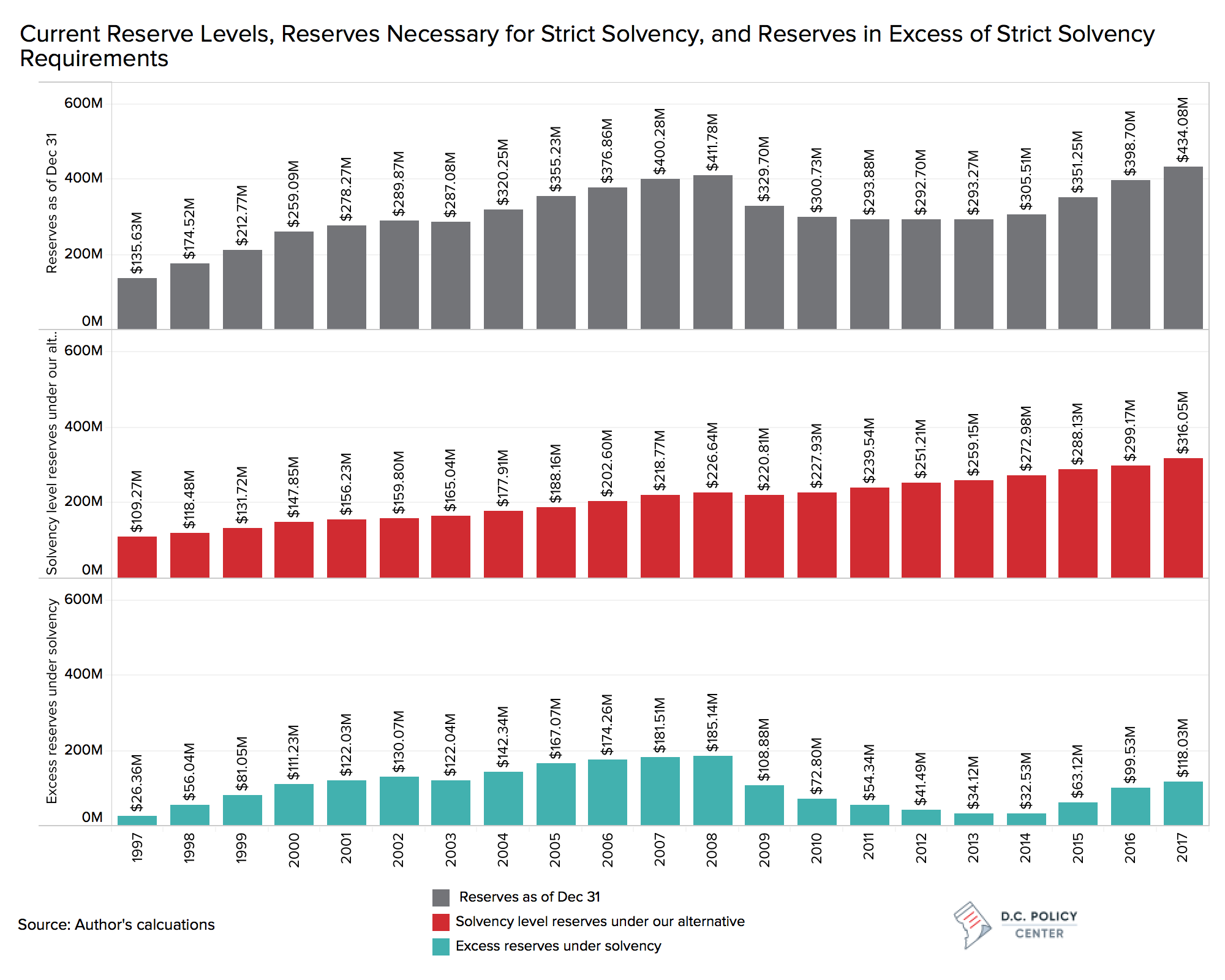

With a look-back period limited the post-reform years, DOL solvency measures show $100 million in reserves more than necessary to meet strict solvency requirements

Lastly, we calculate the amount of reserves that would have kept the DC’s trust fund at 100 percent of strict solvency (reserves in hand pay for worst-case benefits, without relying on any taxes) and compare these to the reserves in hand for each year since 1997. This analysis shows that even through the depths of the Great Recession, the reserves in hand were greater than those under strict solvency levels. It also shows that today, there is possibly $118 million in the reserves that are not necessary for meeting strict solvency criterion. This is $118 million that is sitting and earning meager interest; its opportunity cost is the investments or additional employment it could have paid for.

Importantly, if we don’t change our unemployment system, each year between now and the next recession will continue adding to these excess reserves without much tax relief. Reserves increased by $12 million in 2014, $46 million in 2015, $47 million in 2016, and $35 million in 2017. Given how insensitive tax rates to change in reserves, these increases will continue, imposing ever growing deadweight losses on the District’s economy.

We need to reevaluate the Unemployment Compensation System in DC

As shown, the solvency evaluations from the Department of Labor, when corrected for the lookback period point to a very strong Trust Fund balance. The analysis also shows that the District’s unemployment tax structure produces extremely high reserve balances, largely because its tax structure is costlier than necessary. Each dollar that sits in the reserve beyond a reasonable reserve amount is a loss to the economy. Strong reserves are important to weather recessions; perversely, stronger than necessary reserves are even a bigger cost during downturns, depriving businesses from much needed cash.

The District should reexamine its unemployment system considering the following changes:

- How benefits are determined: While tying the benefits to the inflationary changes is reasonable, any change beyond that should require rigorous examination. This is now absent in the District.

- How benefit costs are projected: There is little information on how, or if at all, the District’s Unemployment Trust Fund projects its benefit costs. This projection should be an important part of the Trust Fund management.

- How system wide tax rates are determined: At present, the systemwide tax rates depend on only one variable—the stock of reserves in the fund. And as shown, the move from one tax table to the next is extremely difficult because of the large reserve ratio bands used in the program (Remember, it takes nearly $200 million of reserves to move from one tax table to another. This is about the full benefits paid in a recessionary year). As a result, the systemwide taxes rarely change. The District should consider alternatives where the taxes depend also on projected overall costs that year (example: Vermont) to produce a tax rate that would be adequate to finance the program costs plus necessary reserves. Few states use this flow approach, but it is an important means of balancing the future flows of benefits without making the system overly burdensome.

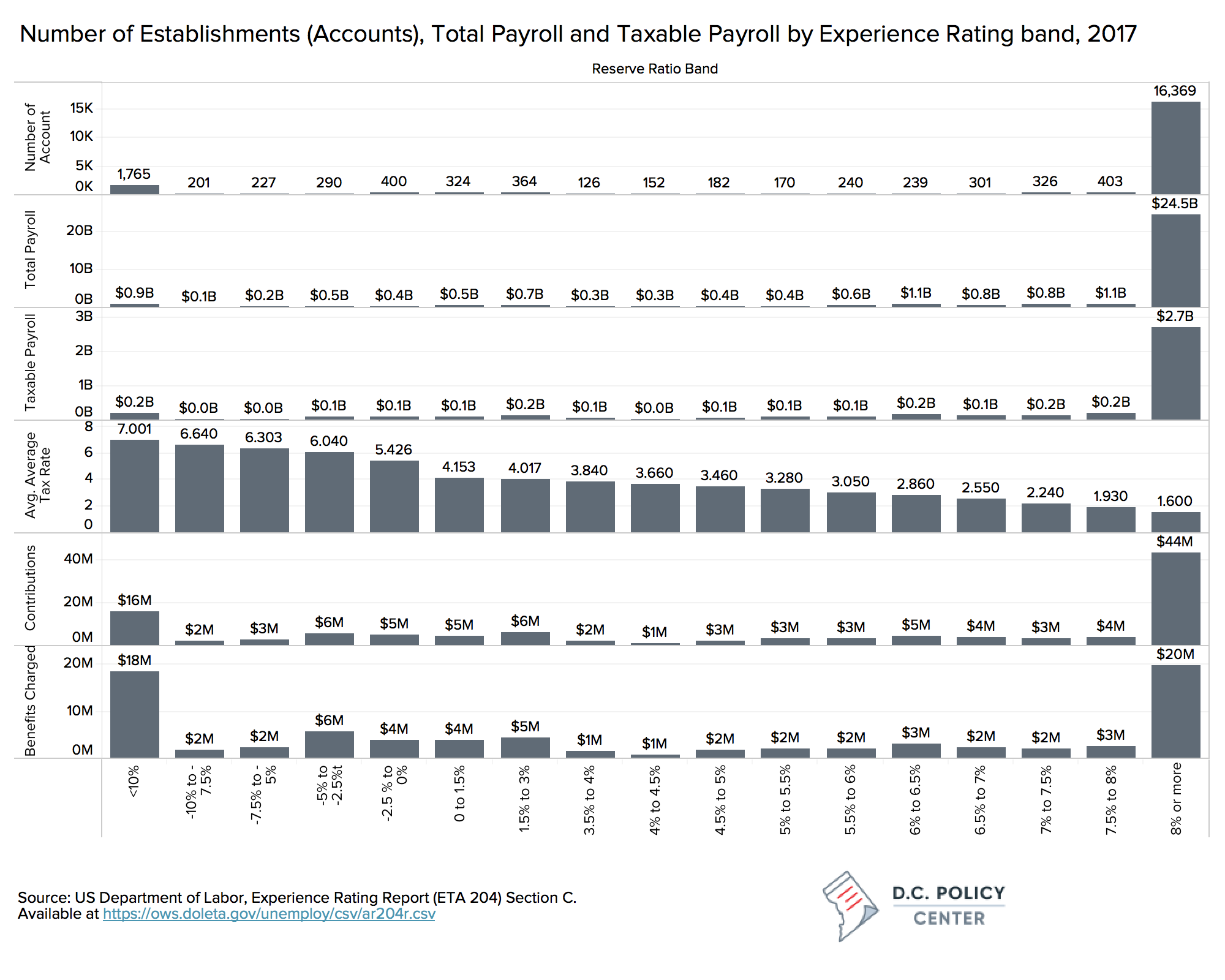

- How individual taxes are determined: in each Tax Table, there are 16 different tax bands, and of those, 14 are largely irrelevant. Of the 22,079 accounts in the program (each account representing an employer), in 2017, 16,369 were in the lowest tax band, 1,765 in the highest tax band (with negative reserves of ten percent or more of their total payroll), and only about 3,000 spread thinly across the remaining fortune bands.In effect, the District’s unemployment tax system is a flat tax of 1.6 percent of taxable wages on all firms, with a solvency charge of 5.5 percent for the extremely insolvent. For the 16,000 firms that occupy the lowest tax band, there is no tax relief until the trust fund reserves reach and estimated $593 million. The District should consider alternative means of determining taxes. At a minimum, the data below shows that the tax bands can be rethought (there is a lot of variation in the group with reserves of 8 percent or more than their payrolls), or the tax rate could be tied to benefit claims, benefit-wage ratios, or even adjust for payroll changes (only Alaska does this in the nation.)

- How solvency is determined: As shown, Department of Labors’s solvency calculations are not particularly useful for the District. The District should develop its own solvency determination metrics that base its calculations on years and experiences most relevant to the District’s unemployment policy history.

- How reserves are managed: At present, there is no policy that is focused on managing reserve levels. The District should have a reserve management and maintenance policy that ensures that if there are funds in excess of solvency levels, they are returned to the taxpayers. This policy should specify whether the reserve levels would be maintained through tax changes or other means (such as refunds to employers in good times, or surcharges during bad times), and the conditions under which each path is taken.

A well-functioning unemployment compensation program should maintain a healthy reserve. But when reserves exceed the needed amounts, there is a cost to the economy. The District’s trust fund balance has exceeded this amount, and yet, it will continue to accumulate funds without any tax relief. This should change. At present, The District has the necessary data and the tools to rethink its unemployment compensation system, and certainly enough experience with diligent fund balance management. All it takes is a bit of work and political will to get there.

Yesim Sayin Taylor is the Executive Director of the D.C. Policy Center.

Notes:

[1] The next systemic tax cut requires the reserve ratio to be at 1.5 percent of total wages. Under current conditions, this would require a reserve of $598 million.

[2]The law requires the Department of Employment Services to use the Department of Labor’s State Benefit Financing Model before making a recommendation on any benefits increases.

[3]In addition, eight states had secured loans from the municipal bond markets.

[4]This is the fund balance at the end of 2017, according to the Department of Labor.

[5]We measure it comparing the reserve ratio—the ratio of reserves to the wages of all workers covered by that state’s unemployment program—to the benefit ratio—the ratio of benefits paid that year to the same wage base.

[6]The benefits can expand with federal support, as happened during the Great Recession. These expanded benefits meant people could pull unemployment benefits for longer periods of time—up to a year compared to 26 months under state rules. The federal government usually pays for half these benefits in DC.

[7]We include in this analysis only states whose UITF did not go bankrupt (requiring the Feds to make them an emergency loan) through the Great Recession so the comparisons include states with relatively conservative unemployment regimes and strong trust funds.

[8]In 2013 the Federal government put in place a change to CFR 606.32 which allows a state to borrow interest free if a state takes a Federal advance after January 1 and repays it by September 30 in the same year. The new statute added a solvency and tax maintenance requirements to the eligibility for these interest free loans. States that cannot meet the payment requirements or fail to pay their loans on time will see an increase on the FUTA tax imposed on businesses.

[9]The federal government, state and local governments, and some non-profits do not pay unemployment taxes. Rather, when their separated employees seek for unemployment benefits, these entities get a bill from the Trust Fund asking for a reimbursement. The employees of the reimbursable entities are not a part of the trust fund, and their wages are excluded from the relevant calculations.