First Take is a regular column by D.C. Policy Center Senior Fellow David Brunori.

“The point to remember is that what the government gives it must first take away.” – John S. Coleman

I have been teaching, writing, and, practicing state and local tax law for more than a quarter century. And, I am convinced of one thing: The fundamental concept that a tax system should be built on a broad base and low rates remains the best way to approach public finance. You should tax everything, and tax at very low rates. This approach maximizes revenue, minimizes economic distortions, and makes both administration and compliance more efficient – and less expensive. Remember, someone else pays for every credit or deduction, or exemption handed out. It is not a surprise that “broad base, low rates” is enshrined in every tax reform study every conducted. See here, here, and for a meta-study of tax commissions, here.

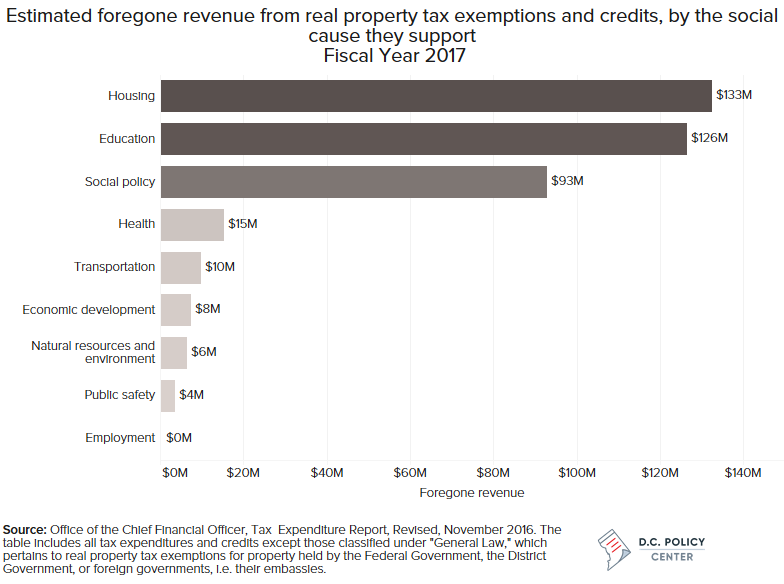

Unfortunately, what makes good tax policy does not always translate politically. Politicians use the tax laws to favor certain constituents (seniors, veterans). They use the tax laws to reward or punish behavior (driving eco-friendly vehicles, smoking). Sometimes politicians use the tax laws to make a statement. None of these approaches represent particularly good tax policy. Data from the Office of the Chief Financial Officer show that the District will forgo an estimated $400 million in real property taxes because of real property tax exemptions and credits it offers to support various social goals.

This year, just two months into the brand new legislative session, we have already seen a handful of tax policies before the council this year. Some of the proposals are better tax policy than others. Let’s start with Bill 22-0044, the Senior Citizen Tax Relief Amendment Act of 2017. As the title suggests, it is primarily aimed at senior citizens –and senior citizens tend to vote. So, this is good politics. But its not bad policy either. This bill would exempt homeowners over 70 years old, with less than $60,000 in income, and who have lived in the same house for 20 or more years from paying tax. The effect on the base appears to be negligible and therefore the distortions are minimized. Seniors in the District already get a 50 percent credit discount on their property taxes if they earn $127,600 or less. The estimated cost of this exemption is approximately $28 million per year. You can find similar credits or exemptions in Montgomery County, Alexandria, and Fairfax, though income eligibility is stricter.

But there is another part of this proposal that isn’t so good from a policy perspective. The bill provides a partial exemption from income tax for government pensions. There is the vicious political cycle for you: Senior citizens, particularly those who worked in government or served in the military, vote a lot more than everyone else. But remember, the District already had this policy, and the 2014 Tax Revision Commission, on which I served, proposed to eliminate this exemption, as a part of base-broadening and the District adopted this proposal in its Fiscal Year 2015 budget. Admittedly, the impact of this exemption is low—under half a million dollars. But will it go to where it is needed the most? For example, a retired flag officer making a large income from consulting. An immediate improvement would be to tie the exemption to income, and not age and occupation.

Bill 22-43, the East End Commercial Real Property Tax Rate Reduction Amendment Act of 2017 aims to encourage investment in certain parts of the city: Commercial property located east of the Anacostia River will get a tax break. The sponsors want to spur investment in poorer parts of the city – a worthy goal. But this proposal represents unsound tax policy for several reasons. First, it has the government picking winners and losers in the market place. The government has never been able to do that effectively or efficiently. Remember Living Social? Second, the proposal neglects an important truism in economic development: Tax breaks such as this play a small role in business investment decisions. There are a lot of factors that matter; these kinds of tax benefits are not usually in the top five. Third, the proposal is inherently unfair to commercial property owners everywhere else in the city. There is nothing fair or just in making the property owner in Northeast or Southwest bear a greater burden than those east of the river.

There is a proposal to exclude from income the annual salary of those employed by the Fraternal Order of Police Metropolitan Police Department Labor Committee and by the International Association of Fire Fighters, Washington D.C. Fire Fighters Association Local 36. This bill, First Responder Income Tax Exclusion Amendment Act of 2017, would exempt the city’s police officers and firefighters from income tax. The goal of the sponsors is to make it easier for public safety personnel to live in the District. And I suspect that the police and fire unions will be a very happy lot if it passes. But this is awful tax policy. There is no tax or economic reason to exclude the income of police and firefighters from tax. Sure, we admire and value what they do. But, why not exclude the income of teachers? Social workers? This bill would create horizontal inequities: that is people who are otherwise making similar amounts of income will bear different levels of tax burden just because of their occupation. It certainly does not feel right. If the city was serious about showing its appreciation for first responders, it should give them a raise – not a tax break.

There is a proposal to alleviate the tax burdens on homeowners and renters near development projects. The Displacement Prevention Amendment Act of 2017 would double the tax credit available to homeowners and renters in certain parts of the city. The goal is to prevent rising housing prices from causing folks to move out.

This bill shows how the government acts strangely at times. It approves development projects in the hope of spurring growth – in the form of higher real estate values. Then it fears those higher real estate values might lead to the dreaded gentrification. Forget for a moment that homeowners like rising property values. The government should be weary of designing policies aimed at deciding who lives where. It just isn’t very good at it.

Finally, there is a proposal to allow a tax credit for people and businesses that donate food to non-profit organizations. The Save Good Food Amendment Act of 2017 offers a more generous benefit that the traditional charitable tax deduction. It will have minimal effects on the tax system and budget. And perhaps that is the bill’s best quality!