In January, the D.C. Policy Center’s Rivlin Initiative launched the first round of the Quarterly Business Sentiments Survey. The goal of the survey is to supply systematic, comprehensive information on the business community’s experiences to elected officials, the media, and the public. Questions center on overall business climates, barriers to growth, and business-related interactions with government. The 2024 Quarter 1 results are outlined below. You may also access a PDF version and a 2-page graphic summary.

The D.C. Policy Center launched the quarterly Business Sentiments Survey to provide a detailed, comprehensive picture of what the business community is experiencing to elected officials, the media, and the broader community. The inaugural survey, which was distributed in January 2024 covered businesses’ experiences during the last quarter of 2023 and expectations for the first half of 2024 regarding hiring decisions, revenue growth, and the local, regional, and national economies. Participants were also invited to answer questions about businesses’ experiences with crime.

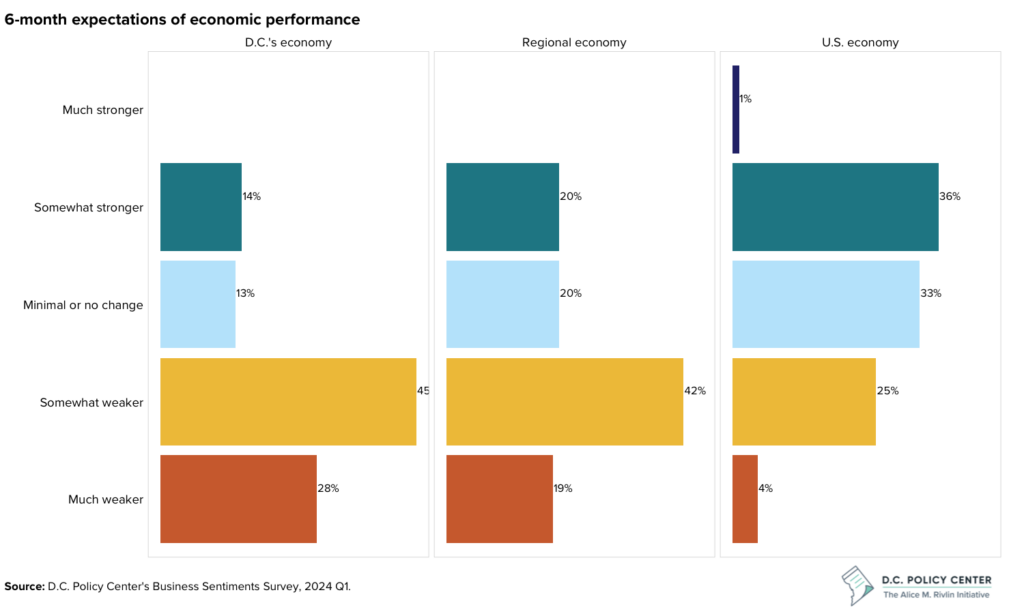

Compared to the metro and national economies, businesses have a dim six-month outlook for the D.C. economy

Compared to the metro economy and the national economies, surveyed businesses appear pessimistic about the state of the D.C. economy six months from now. This pessimism might be driven by multiple factors, such as the hits participants experienced on their operating revenues or sales in the previous quarter, or the little to no job growth between January 2023 and January 2024, which is also tracked in the survey results.1

Given the strong representation of businesses in real estate, rental, and leasing in the survey sample, the pessimism may also be reflective of the weak commercial real estate market. According to Kastle data, office occupancy rates remain below pre-pandemic levels. As of November 2023, D.C.’s Central Business District (CBD) had a vacancy rate of almost 19 percent and an availability rate of 22 percent. With availability rates higher than vacancy rates, the commercial real estate market may further weaken as leases expire. In addition, over the past year or so, the negative net absorption rate of D.C.’s office market was more than 2 million square feet. In fact, when compared to survey respondents from other industries, survey respondents from real estate, rental, and leasing had, on balance, more pessimistic expectations.

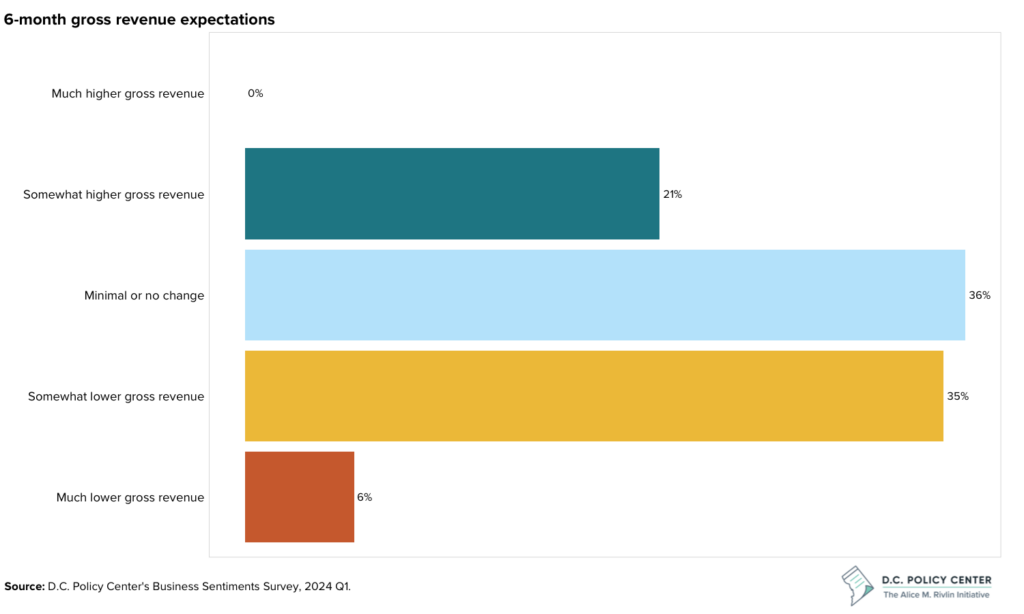

Businesses are bracing for lower revenue

When asked about gross revenue expectations for their operations, about 4 in 10 survey respondents reported that they are expecting “somewhat lower” or “much lower” gross revenues over the next six months. These expectations are consistent with what is reported for the District of Columbia by the Business Trends and Outlook survey. The expectations of lower gross revenues may reflect the relatively lackluster GDP growth in the District compared to the rest of the country. The expectations may also be the impact of higher interest rates on overall business profitability. According to the U.S. Census Bureau, about a quarter of District businesses have noted that higher interest rates have reduced their profits.

Survey respondents from D.C.-only businesses were somewhat more bullish in their expectations, but respondents who represented business establishments that operate in multiple locations in the region were more likely to report planned layoffs and reductions in their retail or office footprints.

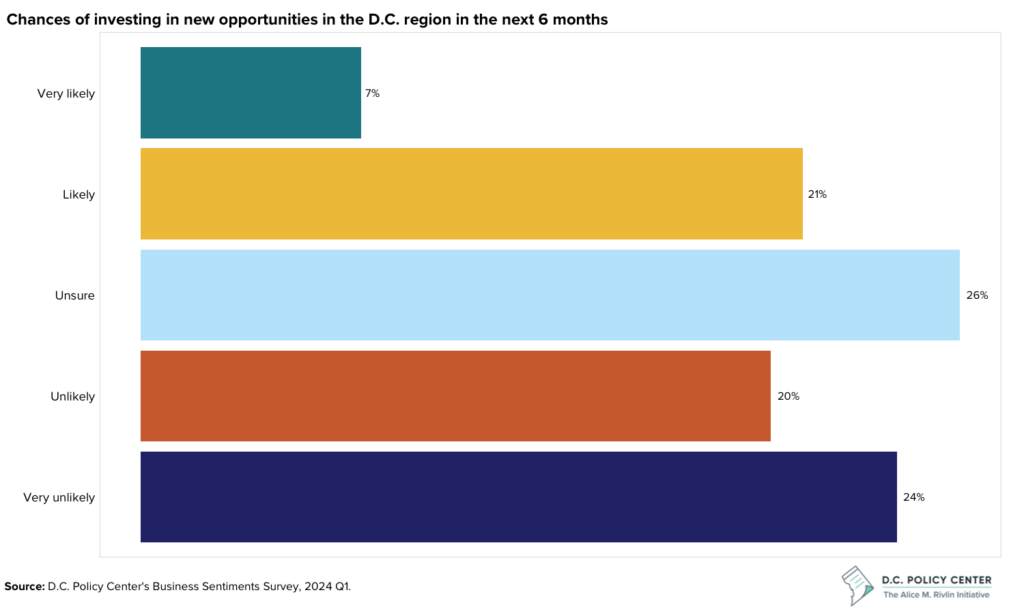

While some businesses still find D.C. an attractive place to invest, in general, interest in regional investments is waning.

44 percent of survey respondents indicated that they are “unlikely” or “very unlikely” to invest in the region. When asked about hypothetical places to invest, businesses that operated exclusively in the District were the most likely to report that they would invest in D.C. In contrast, businesses with region-wide operations were more likely to identify locations in Northern Virginia, such as Arlington, Fairfax County, and Alexandria, as attractive potential investments. Furthermore, the survey responses suggest that business leaders see investments in Arlington and Montgomery County as complementary to their investments in D.C., while investments in further counties like Fairfax and Loudoun are seen as substitutes.

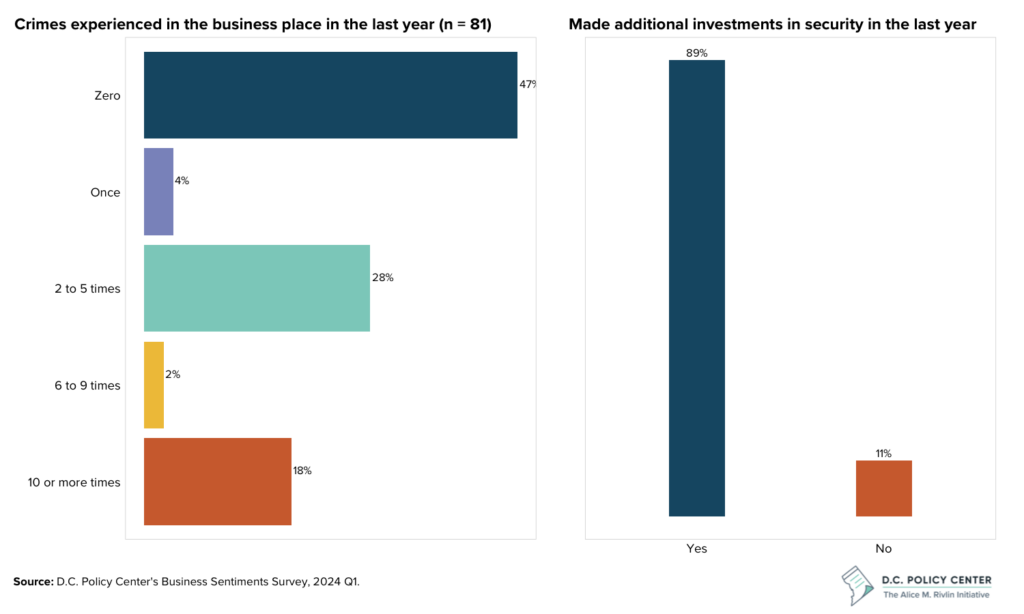

Businesses are investing in crime prevention measures

Almost 9 in 10 survey respondents reported that they made additional investments in security in the last year, and nearly half of the businesses surveyed suffered from two or more incidents of crime. The most common crimes reported by survey participants were property damage and disruptive behavior. In response to elevated levels of crime in 2023, many of the 81 businesses in the optional sample invested in additional security measures—with the most common investments being outdoor and indoor security cameras as well as hiring security personnel.

Grounds for optimism

The survey results also highlight some bright spots. Regarding the economy, 3 in 10 survey respondents from businesses operating exclusively in D.C. reported that they expect to hire additional employees in the next six months. But only 6 percent of survey respondents from businesses who operate in the D.C. region and elsewhere reported that they expect to hire additional employees in the next six months.

Furthermore, despite the downturn of the commercial real estate market in D.C., 78 percent of D.C. exclusive business respondents have no immediate plans to change the square footage of their office or retail space. While some of these decisions may be driven by lease commitments, this observation also suggests that the businesses surveyed are not rushing to change their locations.

Regarding crime, a more optimistic interpretation of the survey results would note that 47 percent of survey respondents did not suffer from any crimes in the past year, and the most common reported crimes were not violent crimes, but property damage and disruptive behavior. Moreover, recent trends are headed in the right direction. According to data from MPD on reported crimes, most types of crime have fallen in 2024 when compared to the same time period in 2023: January 1st to March 22nd. In 2024, the total number of property crimes have declined by 12 percent, and violent crimes have declined by even more—16 percent.

What does this mean for policy?

COVID-19’s transformational impact on the District of Columbia created challenges that will shape the next decade. The D.C. Policy Center’s Business Sentiments survey has captured some of these challenges. The pessimism about the District’s economy, and the lack of interest in investing in D.C. and the broader region, suggest that there is an urgent need for policies that will restore the District’s competitive edge.

First, there is a need to recognize the importance of housing as an economic development strategy. Historically, residents have moved to the District for jobs, but moved out for housing. With remote work breaking the relationship between where people live and where people work, this relationship has reversed. If D.C. successfully attracts and retains residents with qualifications in high demand, the city will also become a more attractive destination for employers. But making the District more attractive will also require public policies that increase the supply of housing and remove the regulatory restrictions that slow the building of new housing. At a more general level, public policies need to be better geared toward making the District a safer, more desirable place for people to live and work.

Second, there is an urgent need for strategies that attract new investments to the District. Historically, the District has outperformed both the Washington metropolitan region and the nation in its economic performance. Moreover, the presence of the federal government made the District less vulnerable to recessions. D.C.’s strong economic performance led to high investment demand from the District’s own investors and from foreign direct investors. But now, economic indicators for the District are less favorable. The District has underperformed the nation and the region in key economic metrics. This fact is apparent in publicly available economic data and in the findings of the Business Sentiments Survey. While some of the shift in investment interest is linked to the changing work culture and population dynamics in the aftermath of the COVID-19 pandemic, the District still has policy tools that can foster a more attractive environment for investment. These policy tools include crafting a more stable, regulatory environment which properly compares costs and benefits, and a regulatory strategy that is consistent and predictable.

Third, there is a need for better city services that support vibrancy and enhance the quality of life. One striking result from the survey is how often businesses have invested in additional measures to improve security. This result probably reflects the fact that the District struggled with high levels of crime in 2023. Among the survey respondents, nine out of ten reported investing in security measures, such as buying indoor and outdoor camaras and hiring security personnel to combat disorderly behavior and property damage. If crime were less of an issue, the surveyed businesses could have used the funds they used for security measures in other, more productive ways.

What next?

The next survey will be distributed on April 16 and will inquire about location decisions and the business climate.

How to interpret the survey results

In the first round, 91 respondents – primarily business owners and senior executives –completed the survey. Businesses with 10 or more years in operation, over $5 million in operating revenue in the last 12 months, and over 100 employees accounted for a substantial portion of the survey sample. While the survey sample is not proportionally representative of all businesses in D.C. and the metro area, the survey captured the views of an influential subset of businesses in the region. The survey results likely do not reflect the full range of opinion in the D.C. region business community.

Given these considerations, these first-round survey results should be viewed as tentative and preliminary. The results point to issues that deserve careful consideration when determining how to re-establish the District’s competitive edge. In future rounds of the survey, the Rivlin Initiative will increase the sample size and create a sample that is representative of all businesses in the D.C. region.