Last Spring, the Chesapeake Climate Action Network (CCAN) began circulating a carbon tax proposal that would impose a gradually increasing tax on carbon emissions in the District of Columbia. Under their proposal, the tax on utilities (gas and electric) would begin at $20 per metric ton of carbon emissions, rising $10 per ton per year, plus the cost of inflation, to reach $150 per metric ton in today’s prices by 2032. The proposal also called for an unspecified amount of fees on parking meters and taxes on users of parking garages.1

One analysis of the bill found that, when fully implemented, the carbon tax could raise $400 million to $600 million per year. We don’t have access to the model that produces these estimates, but if correct, the revenue is significant. To put in context, $400 million to $600 million is 5 to 7 percent of all local revenue the District collects each year, or as much as one third to a half of sales tax revenues. At the higher end of $600 million, it is more than the full amount of business tax revenues.2

Some might see the revenue from a carbon tax a boon, but this tax will undermine the District’s economy and fiscal strengths.

All taxes impose some economic costs, but costs of a carbon tax imposed on the District businesses and residents only, and not the rest of the metro area, will be especially high. The tax will increase both the cost of goods and services produced in the city and the cost of capital. Higher cost of doing business will reduce real wages, forcing workers to either accept lower paying jobs, or look for work elsewhere in the metro area where there would be no such cost pressures. Lower returns to investment will reduce investment in the city, as investors will look for higher returns elsewhere. The interaction of the carbon tax with other taxes on businesses and individuals will compound these economic losses. As a result, the District’s economic output and employment–especially among DC residents–will decline. The tax revenue, no matter how high and however it is used, will not be sufficient to cover the cost of lost wages and income or the economic activity that drains away from the city.

Some advocates of carbon tax wave this problem away by arguing that a carbon tax returned to households as a “rebate” would not add to the government’s bottom line. They argue that rebating carbon tax revenues would simply shift economic activity from one sector to another without any significant economic or competitive impacts. This argument is certainly a part of CCANs proposal: its economic analysis show that their carbon tax will cause no job losses (Figure 1 in the study it uses),3 and will increase the pace of economic growth (Figure 2).

CCAN points to a lot of modeling and number crunching to justify this finding. But the underlying premise—that a government-engineered wealth transfer from businesses to low-income residents puts resources in higher, economically more productive uses than private investment and spending—is false according to both national research (two summaries here, and here)4 and research on the District of Columbia. 5 This is not to say that the underlying desires to reduce greenhouse gas emissions and to support income security are not worthy causes. It is to say, however, that there is a cost to climate action that must be properly understood.

Importantly, experience from elsewhere shows that revenue from a carbon tax becomes a political football when spent to benefit targeted groups rather than used towards broad-based tax reductions. We can learn from experiences from British Columbia, which shows that the carbon tax has generally worked to muddy the fiscal picture in that province. Carbon tax revenue there have increasingly paid for tax expenditures for specialized interests, becoming a drain on the general fund.

If the goal is to institute a tax that makes the polluters bear the full social cost of their private actions—what to do with the revenue is entirely secondary to the desired outcomes.6

The primary goal of a carbon tax is to increase the cost of emitting greenhouse gasses and induce people to move away from carbon-intensive energy.

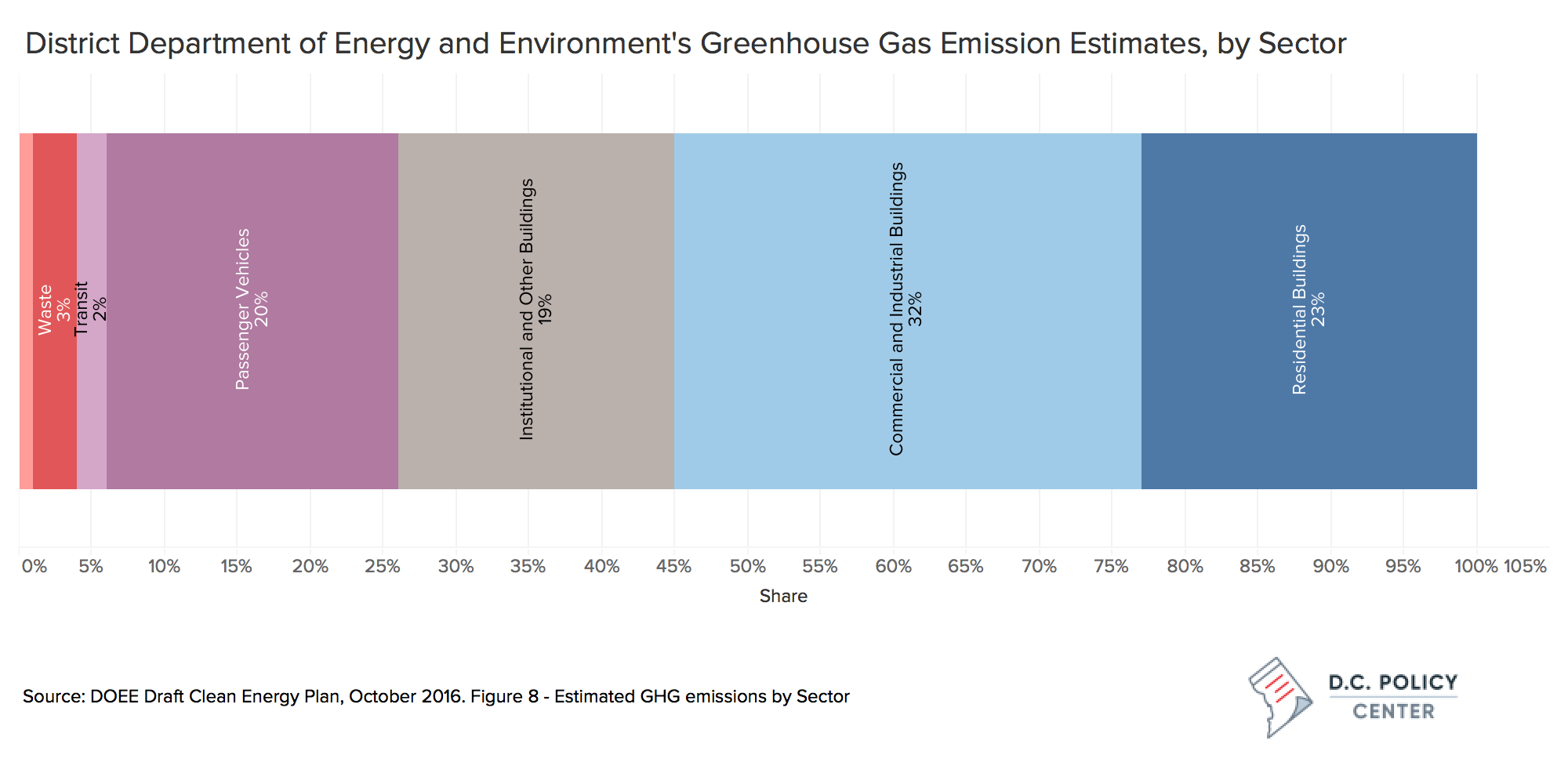

The District has no carbon-based energy production or carbon intensive manufacturing, so the tax will fall largely on buildings. In response to a tax, consumers would reduce energy use or switch to low- or zero-carbon energy. They would invest in energy-efficient alternatives (switch to LED lights, or weatherproof their homes), cut energy use (set the thermostat to 78 degrees rather than 72 during summer months, or turn off the lights when we leave our offices or our bedrooms), or switch to a different energy source (install solar panels or choose a renewable source of energy through our energy purchase contracts).

The tax, thus, works to change behavior.

Why do carbon tax proposals focus so much on the revenue?

The revenue is a welcome by-product as it allows for the building of political coalitions to support the passage of a carbon tax.

Taxes are costly so any revenue that offsets those costs can help reduce resistance to a new tax. The revenue from a carbon tax can certainly go to meet fiscal needs, but it is generally used to solve the particularly difficult political problem of making people accept paying a new tax today when benefits are uncertain and fairly far in the future. Some want assurance that the money is put to good use or invested in causes they believe in; others want to reduce taxes imposed elsewhere; others want to make sure low-income residents who would be hit by a carbon tax are “made whole;” and yet others call for reduction of future budget deficits.

CCAN’s carbon tax proposal leans heavily on rebates to residents. The proposal returns 75 percent of the tax proceeds as rebates, with the lowest income residents receiving transfers four times the carbon tax they would pay. Of the remaining 25 percent, the bulk would have been allocated to green investments, and only 5 percent, according to one characterization, to appease business interests. Given that the commercial sector accounts for 62 percent of total electricity consumption and 54 percent of natural gas consumption, the proposal is a redistribution scheme from the commercial to the residential sector.

Public support for carbon pricing is responsive to what policies propose to do with the revenue.

The redistribution elements of the CCAN proposal are not about getting the economic impacts right. They are largely based on the politically pragmatic calculation that “tax and rebate” will be the best way to build a coalition that would appeal to the sympathies of the District’s progressive voters and elected leaders.

Compare the CCAN proposal with the one Maryland Senate rejected earlier this year. As our neighbors, Marylanders face similar climate risks and pollution factors. That state emits more carbon dioxide per capita (9.9 metric tons in 2015) compared to DC (4.5 metric tons) and has underperformed the District’s significant achievements in carbon emissions reductions since 2000. (DC experienced a 40 percent reductions in per capita emissions compared to 32 percent in Maryland, and 30 percent in total emission reductions compared to 23.2 percent in Maryland.) Given Maryland’s poorer performance against similar risks, one would expect climate advocates to push for aggressive carbon pricing. But the Maryland proposal called for a $15 tax, to reach a maximum of $45 in seven years: less than one-third of what is being called for in DC. These numbers do not appear to reflect what is socially optimal or economically reasonable, but politically feasible.

Back to DC, the CCAN proposal must have miscalculated the elected leaders’ appetite for redistribution. After over a year of campaigning, they have not yet been able to convert their proposal into a bill. The alternative policy summary circulated by Councilmember Mary Cheh’s office suggests a modest ambition for rebates–with decisions on rebate amounts left to a future commission– and more aggressive investments in clean energy, retrofits, and such.

To be sure, the CCAN proposal reflects lessons carbon tax advocates learned elsewhere. Carbon tax proposals have also been forwarded in Washington State, Oregon, Vermont, Massachusetts, and Connecticut. But optimizing revenue use to build successful political coalitions has proven difficult, and this in large part explains the failure of many of these state level carbon tax initiatives. For example, Washington state’s Initiative 732 in 2016—the closest any U.S. state got to passing a carbon tax—lost support from environmental organizations such as Sierra Club because, in its opinion, too much of the revenue would have been sent back to businesses and not enough to social justice, environmental, and health causes. Had it been approved, Initiative 732 would have imposed a $15 per ton tax on fossil fuels (including fuels used to produce power) that would gradually go up to $100—a much more aggressive pricing scheme than proposed elsewhere. Revenues would have been used to reduce the state sales tax, business taxes on manufacturers, and provide funding for an Earned Income Tax Credit state-match. This centrist, everyone-gets-a-bit approach fell short of consolidating political support. In the aftermath of its defeat, many in the environmental community marveled (here, and here) at the missed opportunity.

Since then, the governor of Washington state proposed a carbon tax plan which would have used the revenue to cover budget deficits; a proposal that has also been rejected and withdrawn. There is now a new ballot Initiative, which looks a bit more like a political sausage. For example, this new initiative calls the imposition a “pollution fee” with proceeds going to programmatic (and not tax) expenditures specifically focused on clean energy. But more importantly, the initiative carves out exemptions for trade-sensitive industries, and exempts a coal-powered generation plant in the state from carbon taxes until 2025, when that plant is slated to close.7

The fiscal risks of revenue swaps: The case of British Columbia

Before taking sides in a carbon tax debate, we must fully understand the economic impacts of a unilateral carbon tax in the District. At present the level of detail needed to model the CCAN proposal or the Cheh alternative are not public. At a minimum, what we know from basic economics tells us that a carbon tax imposed only in the District and not the rest of the metropolitan area will create a cost discrepancy. The discrepancy will depend on the level of the tax and what sectors it covers. Given the regional context where the District already competes with jurisdictions with much more lenient environmental policies, the city cannot counter this discrepancy by any other policy save for tax cuts of similar magnitudes on labor or capital. We cannot prevent leakages, impose tariffs or taxes on goods and services produced outside of the city in the metro area, or ban businesses from leaving.

Importantly, the argument that a carbon tax if rebated or swapped for tax expenditures will not hurt the economy needs extreme scrutiny. Rebates or revenue swaps are not inherent features of good, or even stable tax policy. They are not necessary or sufficient for effective climate action. Nor do they guarantee that economic impacts are fully mitigated. Revenue swaps or rebates are useful because they allow politicians to effectively signal to the public that the carbon tax will not be another revenue-grab.

Even were a carbon tax proposal able to mobilize and sustain a successful political coalition through judicious language, including the use of revenue, that political equilibrium does not stay intact forever. The case of British Columbia, which, over time, allowed its carbon tax to erode its tax base and fuel the expansion of targeted handouts, provides an important cautionary tale about the fiscal risks in play.

British Colombia enacted its broad-based carbon tax in 2008. The tax began at $10 (Canadian dollars) per metric ton in July of 2008, and gradually increased to $30 per metric ton by 2014.[note] In North America, the only other example of carbon tax is Boulder, Colorado’s very modest tax on electricity consumption. In addition to carbon taxes there are cap-and-trade regimes similar to the one in California (which partners with Ontario, selling credits to each other), and the Regional Greenhouse Gas Initiative, which includes at present 9 states, but will go up to 11 when Virginia and New Jersey join next year. These regimes cap the amount of carbon that can be emitted and allow the price to vary. Other state-level proposals (some already defeated) for carbon tax regimes vary with respect to the base they tax and the amount of the tax. A full account of carbon pricing should however include all types of motor fuel taxes, taxes on utilities, severance taxes, Renewable Energy Portfolio Standards, Building Codes, etc.[/note] Since then, the tax is credited with an estimated 5 to 15 percent reductions in carbon emissions without significant negative impacts on the economy. The public support for the tax was as low as 40 percent in 2008, but reached 65 percent four years after implementation, suggesting that the tax was quickly internalized by the residents.

But this is only one part of the story. The other part is how the carbon tax impacted the local finances of British Columbia.

Barry Rabe, a political scientist who specializes in the politics of carbon pricing, recently published a book called “Can We Price Carbon?” The book is generally optimistic about carbon pricing, but also provides an insightful review of the political process that led to British Columbia’s adoption of a carbon tax and the consequent fiscal implications.

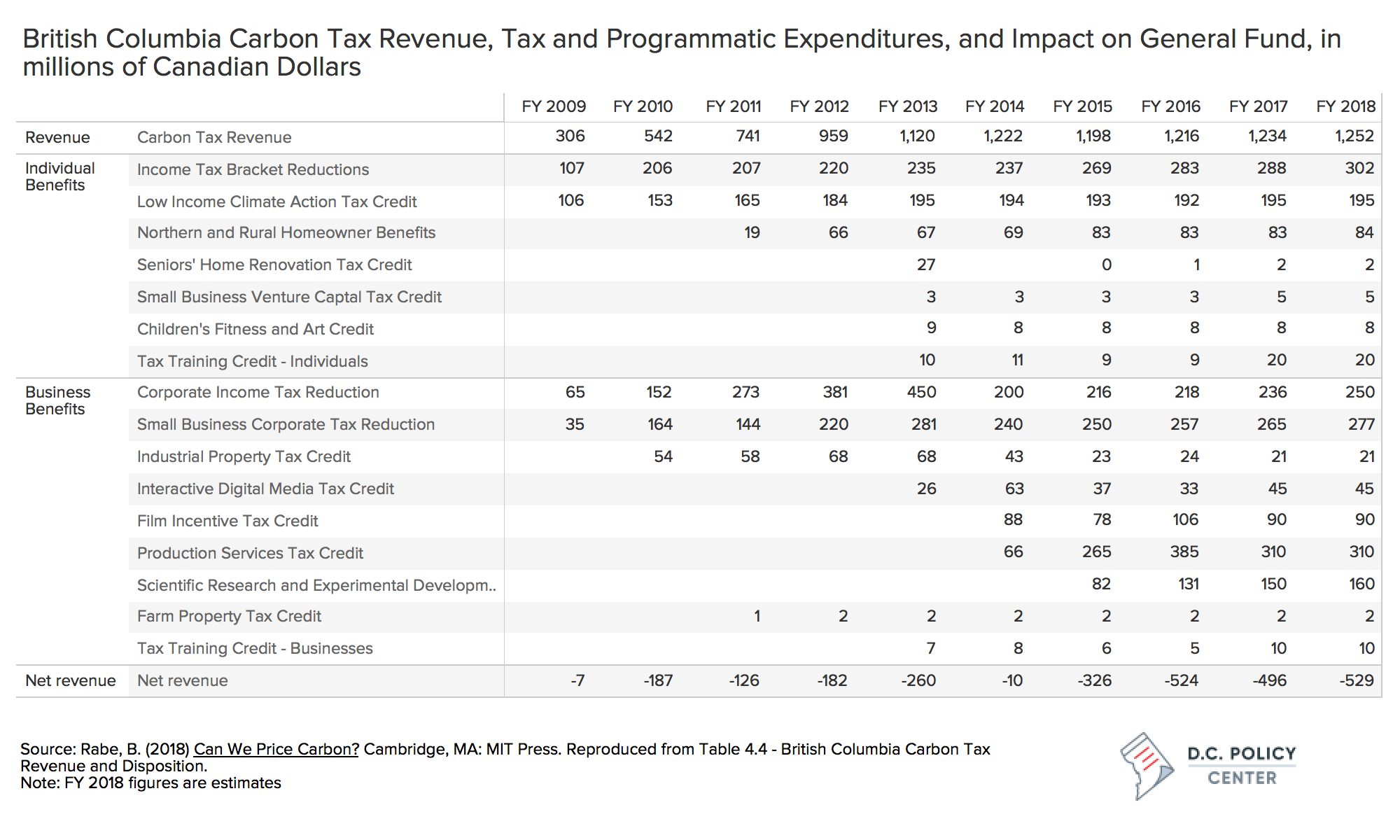

When enacted in 2008, British Columbia’s Carbon Tax Act required all revenue collected by the carbon tax to be used to pay for tax cuts and tax credits. This “revenue neutrality” requirement meant whatever taxes were collected would be returned back to residents or businesses in the form of tax cuts or tax expenditures. In its first year, the carbon tax collected $306 million (Canadian dollars) in taxes, but the law gave away $315 million, draining $7 million from general fund revenue. The province recognized the “revenue negative” nature of the carbon taxes and related tax expenditures, but they thought the problem would go away over time as tax revenue increased.

It did not happen. By its tenth year, carbon taxes yielded $9.8 billion in tax revenue, but a total of $12.4 billion of that revenue was spent under the law, eroding general fund expenditures by $2.6 billion (or about 1.9 percent of provincial tax revenue). An important aspect of this was the shift of various tax expenditures from the general ledger to the carbon tax (Interactive Digital Media Tax Credits in 2013, and then the Movie Tax Incentives—a particularly useless handout—in 2014, and finally, handouts to oil companies under the fancy name of “Scientific Research and Experimental Development Tax Credit.”)

One way to look at this is that the carbon tax is now paying for tax expenditures that have nothing to do with environmental benefits. The other way is to say that tax policy is no longer geared towards paying for basic government expenditures such as education, public safety, whatever else we consider important for public financing. Either way, these policy choices have undermined tax policy.

British Columbia gave up the ghost this year by removing the requirement for revenue-neutrality while increasing the tax to $50 by 2021. The revenue generated from the changes can now be used to, according to Premier Horgan to “create jobs, benefit communities and reduce climate pollution.” The first two items on that list–jobs and communities–are the usual rhetoric you will hear when governments spend your tax dollars. The last item, “climate pollution,” perhaps an unintended mix of “climate action” and “environmental pollution” is what the tax was meant to do in the first place.

The only meaningful carbon tax in North America has cost British Columbia’s general fund $2.6 billion because its proceeds have been a political football. With $600 million in new annual expenditures planned for the District’s carbon tax proceeds, can we reasonably expect a different result?

Some might argue that the District’s Chief Financial Officer will be the watchdog that prevents fiscally imprudent outcomes. To be sure the CFO enforces balanced budgets.But it was the tax expenditures that got out of hand in British Columbia, and its government had to look elsewhere to pay for schools, infrastructure and other public needs. In the District, too, if a carbon tax becomes a means of creating targeted benefits that have nothing to do with basic public needs, under balanced budgets, the resources necessary to meet these needs will decline forcing more tax increases. That may be fiscal discipline, but it is not fiscal strength.

Endnotes

- A carbon pricing proposal, if it moves forward as legislation, will likely look different. On May 18, Councilmember Mary Cheh released an alternative draft policy that already deviates from the original CCAN proposal. You can find the summary proposal here and the CCAN analysis that compares it to the original proposal here.

- The District collects income taxes of $347 million from corporations and $173 million from unincorporated businesses.

- The summary of the economic impact study is silent on the wage effects.

- One research paper from Resources for the Future that examines the economic impacts of national carbon taxes notes that a lump-sum rebate, similar to what is being considered in DC is the least efficient policy. If the revenues were to be recycled into the economy, the better alternatives are cutting taxes on labor or capital. Another study which examines competitiveness concerns under a national carbon tax and how to evaluate these concerns is particularly important for the District in the context of a DC-only carbon tax. Separately, the Congressional Budget Office notes: “… carbon tax revenues could be directed to low-income households in the form of fixed (lump-sum) payments. … Such payments could help offset the increase in living expenses that those households would experience because of a carbon tax.However, unlike using carbon tax revenues to reduce deficits or marginal tax rates, using them to provide relief from the tax’s effects on certain groups would not lessen the total economic costs of a carbon tax, including the reduction in total output. For example, lump-sum payments to low-income households would not provide benefits to the broader economy under normal economic conditions, because those payments would not increase people’s incentives to work or invest and thus would not lead to greater economic productivity.

- To wit, a recent analysis of basic minimum income the DC Council Budget Office conducted shows that a wealth transfer from high income to low income residents can lead to significant job losses in the District and for DC residents. One scenario that transfers $380 million in personal income taxes to low income residents reduces DC jobs by 1,600; resident employment by 9,100, and Gross State Product by $99 million. Another scenario that transfers $710 million results in resident employment loss of 17,300 and GDP loss of $185 million by 2027. CCAN advocates use the same type of modeling, and use the same software, but find that if the transfer is from businesses to individuals, the effects are positive.

- There is a robust literature on what the social cost of carbon dioxide emissions might be (see here for a broad overview, here for a historical EPA ruling, here for a view from Brookings Institution, here on how NY State has evaluated it.) This literature tries to add up all the quantifiable costs and benefits of emitting one additional ton of CO2, in monetary terms, such as costs of rising sea levels, heath waves and associated health costs, but the estimates vary greatly depending on discount rates. If we value future generations—our grand, grandchildren, the same way we value our children, the social costs would be higher.

- This exemption has been engineered by environmental organizations, who in the first place negotiated the closing of this same coal plant.