This is the second part in a series. Click here to read part 1.

At first glance, the grainy thumbnail photo embedded in the email didn’t tell us much, but the price and address said enough: Click now! This could be your dream home!

Specifically, they described a three-bedroom, 1.5-bathroom row house in Mt. Pleasant, about five blocks from the Columbia Heights Metro station, with a listing price of $600,000. Our real estate agent sends us links like this from the Metropolitan Regional Information Systems Inc. (MRIS), a database of regional real estate listings, several times a week.

Our goal is to find a home within walking distance to Metrorail and close to all we love about D.C. – the restaurants, shopping, culture venues, and sporting events. As I discussed in my previous column, we’re returning to D.C. in July after spending two years in South Korea. My wife, a Lieutenant Commander in the Navy, will be starting a new job at the Pentagon (a billet that, incidentally, does not include parking).

So the Mt. Pleasant home sounded promising. Its price tag was crucial, coming in at just less than the $636,150 borrowing limit set for D.C. by he Federal Housing Administration and Department of Veterans Affairs(VA). But this location was clutch. Columbia Heights has shopping and restaurants. The nearby Metro station offers an easy commute to the Pentagon, Verizon Center, and Nationals Park. Perhaps most significantly, through a quirk in the way D.C. sets school boundaries, this home is inside a little pocket of homes east of Rock Creek Park assigned to Deal Middle School and Wilson High School. We have three small kids, the oldest poised to start kindergarten in the fall, so now we pay attention to schools.

The catch

Then reality hit, in a two-word phrase: “Contractor’s dream!” the seller had written. “Every room needs major repairs. Property to be sold ‘as is’ in the current condition.”

“Contractor’s dream,” though cheery, is a dispiriting phrase to a home-buyer, raising the specter of potentially tens of thousands of dollars in necessary repairs. Sadly, this $600,000 Mt. Pleasant rehab project is fairly representative of the only properties we’ve seen that check all the boxes: Near Metro stops, inside the Wilson High School zone, and with listing prices under the VA and FHA borrowing caps.

Like an increasing number of our peers, we’re struggling to afford our desire to live in D.C. and inside a good school zone. The rate of homeownership among the District’s young adult population – the folks most likely to be starting new families – lags far behind the national average, according to a recent study.

In 2015, the D.C. Office of Revenue Analysis found a mere 17 percent of D.C. Millennials and 43 percent of D.C. Gen X’ers owned homes, according to U.S. Census data. Nationally, the homeownership rate for Millennials is 34 percent and 63 percent for Gen X’ers.

If a Millennial or Gen X’er has a child, they’re much more likely to leave the city entirely than remain and own a home. Based on an analysis of tax rolls, the Office of Revenue in another 2015 study estimated when tax filers first add a dependent, usually a child, they have a 65 percent chance of moving away from D.C.

My wife and I were hoping to buck these trends by moving into D.C. with three kids. We’re luckier than many other potential home-buyers: We’re due to receive from the Navy a monthly housing allowance of $3,042 – enough to cover the monthly payment of a VA loan. Through the VA, we can borrow up the maximum allowed amount ($636,150) with no money down and a desirable interest rate. Yes, we could stomach a higher monthly mortgage payment, but we probably wouldn’t qualify for much more of a mortgage.

What our budget buys

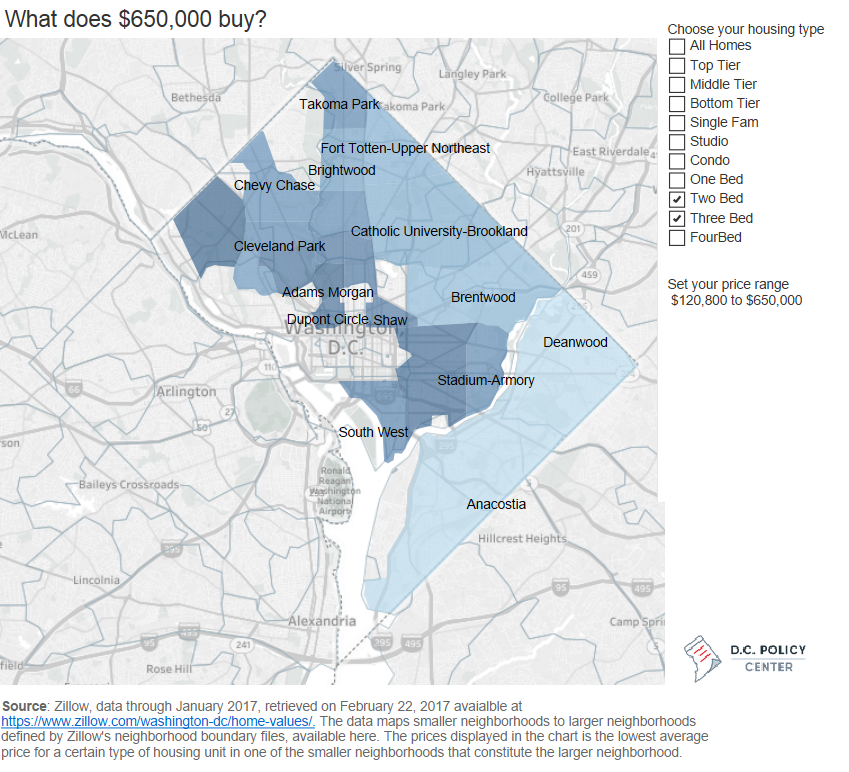

This budget, though, only seems to put us in a “teardown” within walking distance to Metro and (at best) on the outer fringes of a desirable school zone. Our search for an affordable home, with a short commute, inside desirable school districts, and near various entertainment attractions would be much easier in other places the Navy could have sent us.

[Click here for an interactive version of this map]

In San Diego, for example, our housing allowance would be $3,339 per month, but with slightly lower FHA and VA borrowing cap of $612,950. No problem, since a myriad of three-bedroom/three-bathroom, 2,000-square-foot homes are currently listed for sale in the $500,000 range, according to Zillow.com Even Chula Vista, San Diego’s version of has plenty of homes for sale below the FHA and VA borrowing limit.

As for Arlington, there’s not much within our budget, and virtually nothing near Metro. What is for sale seems to be considered “great investment” properties. One, home, near the Pentagon, with an affordable listing of $469,000, is a corner lot, has ‘great solar potential,’ has no central air, and potential buyers are warned, “DO NOT ENTER THE HOUSE. The house is not accessible and walk the lot. Sold ‘as is.’”

Our options significantly increase in Montgomery, Prince George’s, and Fairfax Counties. Many homes currently on the market require only relatively minor cosmetic improvements to meet our housing wish list. The problem is commuting from these communities takes much longer than traveling from D.C.

Meanwhile in the District, considering homes further away from downtown and outside the much sought-after Wilson school zone does increases the quantity for sale within our budget, but not the quality of the housing stock:

- Consider the 2,400-square-foot rambler home recently listed with an eye-catching $475,000 sales price. Its location was just blocks from the Takoma Park Metro station, but the following note from the seller dashed our hopes: “Property currently is livable but needs updating. Sold as-is.”

- Take another Takoma home, listed with a $580,900 price. It was attractive, but also came with an ominous sounding seller’s note: “Back on a market. Contract fell through. Great Investment property, investors dream. [sic] Property sold strictly ‘AS IS.’” The MRIS listing only had exterior shots and did not list square feet, another red flag.

- Even in Brightwood, nowhere near a Metro stop, what’s available is best exemplified by the 1,700-square-foot home listed for sale at $550,000. It has a garage and decently maintained interior, both points in its favor. But living here would mean a long commute by bus to Metro. And with old appliances and no central air, we’d also need to spend tens of thousands of dollars – or more – to make this home even comparable to what is currently available just across the D.C.-Maryland border in Silver Spring.

After sending us a few batches of D.C. listings, our real estate agent conceded to being surprised by the general shabbiness of what’s available in our budget.

Buying a massive rehab project at the upper end of our borrowing power just isn’t realistic for us. We have three small kids, and my wife is moving into a high stress/long hour job – we don’t have the funds or the time. Plus, if we had the money to spend on a massive renovation, we’d probably have the money to afford a small move-in ready home west of Rock Creek Park, whose high-quality schools would help make up for a longer commute.

We haven’t given up on D.C., but we recognize the window for buying a post-renovation row house for $550,000 a block from Petworth or Columbia Heights Metro has closed. Now it’s time to consider how far of a commute is too far out for our home search.

This is the second part in a series chronicling the author’s family’s search for a home D.C. Continue reading part 3: Threading the needle between housing costs and school value.