As the D.C. Council is considering the appointment of a new Chief Financial Officer, the District is facing headwinds unlike any we have seen in recent history. In her testimony, Executive Director Yesim Sayin notes that we now seem to be entering a period where the city’s economy and population growth are no longer outpacing the nation.

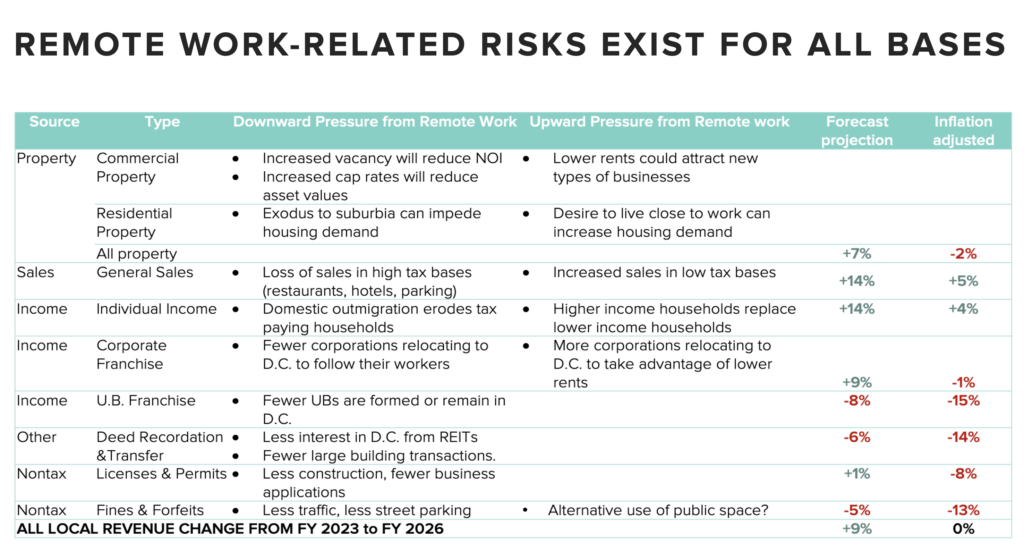

Remote work is changing the geography of work and the District is losing residents, taxpayers, and commuters. Given this picture, the new CFO must build on the existing practices at the Office of the Chief Financial Officer that have created fiscal resiliency: conservative revenue estimates, strong reserves, careful planning for capital needs, and maintaining low levels of debt.

You can read her testimony below or download a PDF version.

Good morning, Chairman McDuffie and members of the Committee. My name is Yesim Sayin, and I am the Executive Director of the D.C. Policy Center—an independent non-partisan think tank advancing policies for a strong, competitive, and vibrant economy in the District of Columbia.

As we welcome a new CFO to the city, the District is facing headwinds unlike any we have seen in recent history. Main sources of economic vibrancy and resiliency in the city are showing significant signs of weakness, impacting District’s key revenue sources:

Loss of population and income taxes

Three sources of data—the Census,1 the IRS migration files,2 and change of address from the US Postal Service3—show that outmigration from the city has become the norm. Leavers are concentrated among households with taxable incomes above $100,000 and those between the ages of 26 and 45. Together with declining birth rates, the loss of this age group means that, in the future, births will not be strong enough to be an important driver of population growth.

The District’s income tax revenues remained strong during the pandemic, driven by the stock market performance on the asset side, and growing wage and salary income reflecting high-wage jobs replacing low-wage jobs on the withholding side. Inflation poses a significant risk to the markets and will likely result in continued asset-value adjustments. And the city’s increased reliance on individual income taxes from a shrinking taxpayer base will likely increase volatility in tax collections.

Loss of commuters and sales taxes

As remote work is taking hold, it is breaking the relationship between where people live and where they work. Historically, proximity to work has been a key driver of population growth in the District of Columbia. And commuters have been an important source of economic activity, both supporting the local service economy and sustaining the demand for office space.

The majority of the District’s commuters have jobs that can be worked remotely,4 and for them, a two-day or three-day in-person work week is becoming the norm. Kastle data shows that Downtown offices reach peak occupancy at below 50 percent Tuesdays through Thursdays and remain largely empty Mondays and Fridays.5 This trend comports with what is happening elsewhere in the country.6 On average, employers appear to have settled on a three-day in-person work week as their desired schedule, but do not appear to enforce this on their workers.

At the D.C. Policy Center, we estimate 155,500 commuters who work in the District but live elsewhere could permanently switch to remote work, visiting their offices only twice a week. This translates into a prolonged demand shock for the local service economy, and a permanent loss of $779 million in sales volume per year and a $62 million loss in sales tax revenue.7

Increased telework also has implications for the Metro’s funding needs—another fiscal concern for the future.

Weakened office demand and property taxes

In the District, 975 large commercial office buildings—

Office vacancy rates are at historically high levels and have pushed above 18 percent in the Central Business District. Across the city, about 20 million square feet of office space remains empty, and 422 buildings in Downtown and Golden Triangle BID areas account for 15 million square feet of this space.

At the D.C. Policy Center, we estimate that if leasing activity does not improve, vacancy rates could push past 25 percent in Downtown and Golden Triangle BID areas (adding 7 million square foot more to vacant space), reducing value by an additional $4.6 billion, and reducing tax collections by $100 million just from these two BID areas.

Looking forward

We seem now to be entering a period where the city’s economy and population growth are no longer outpacing the nation—in fact, just to keep pace would be a good outcome. The future of D.C.’s tax base depends mostly on things that are congruent with, but somewhat outside of, the realm of fiscal policy—things like federal spending, the attractiveness of a DC location in private sector and household decisions, tourism, housing prices, public safety, and the quality of public services.

Importantly, the city’s finances rely on a one-time spending of $2.4 billion through the FY 2023-26 budget and financial plan period, with recurring revenues projected to remain below recurring expenditures in each year of the four-year plan. This means the city’s finances are betting on economic growth, and the current picture suggests that this type of growth is unlikely to materialize.

Given this picture, strong leadership at the Office of the Chief Financial Officer will be all the more important in the coming years. I hope that Mr. Glen Lee will build on the existing practices at the OCFO that have created fiscal resiliency: conservative revenue estimates, strong reserves, careful planning for capital needs, and maintaining low levels of debt. I also encourage Mr. Lee to expand the existing efforts for improvement in the following areas:

- Tax administration, especially in the areas of customer service and commercial property tax assessments. For example, the most recent assessments foresee a $2 billion increase in values in downtown offices—a puzzling number given the state of Downtown. This will likely lead to a lot of angst among taxpayers and lead to costly appeals.

- Expenditure side analysis: The District is a city that is used to planning for growth. While the loss of $62 million in sales taxes, or $100 million in real property taxes, may appear to be insignificant compared to overall local revenue (at slightly above $10 billion), there is no real way to shift this burden to another tax base without significant disruptions. This means, sooner or later, the city would have to consider spending cuts. While the difficult job of cutting spending would fall on the Mayor and the Council, a detailed expenditure analysis from the OCFO can certainly help elected officials make informed decisions and codify such cuts in the budget and financial plan–as a contingency–so the city has a clear plan that preserves spending priorities.

I am so glad that the District has been able to attract a CFO candidate as talented and experienced as Mr. Glen Lee. He will find a dedicated and tireless staff ready to support him at the OCFO. I am also very happy that Dr. Fitzroy Lee will remain as the Chief Economist upon stepping down from his current position. His steady hand and depth of knowledge will be much needed in the coming years. Thank you for the opportunity to testify. I am happy to answer any questions.

Endnotes

- Sunaina Bakshi Kathphalia (2022). Pandemic-induced exodus has broken the District’s population boom. D.C. Policy Center.

- Bailey McConnell and Yesim Sayin (2022). Puzzle of the week: Why are D.C.’s withholding taxes growing, if residents and tax filers are leaving? D.C. Policy Center.

- See the two essays by Ginger Moored at District Measured: “D.C. lost at least 17,000 more people during the pandemic than in the prior year, according to USPS data on net moves. At least 9,000 of the loss appears to be permanent” published on July 8, 2021 and Pandemic led to DC population loss, but data suggests population rebound last summer published on February 10, 2022

- Jonathan I. Dingel and Brent Neiman (2020). How Many Jobs Can Be Done at Home? NBER Working Paper 26948

- Kastle Key Holder Activity Report for the week of June 6 for Downtown D.C.

- Jose Maria Barrero, Nicholas Bloom, and Steven J. Davis (2022). Survey of Working Arrangements and Attitudes (SWAA) June Update published on June 13, 2022.

- Bailey McConnell and Yesim Sayin, Remote Work and Future of D.C., Part 2, forthcoming. Also see detailed estimates presented to the D.C. Council on April 22, 2022.