On Tuesday, November 22, 2022, Executive Director Yesim Sayin testified before the D.C. Council Committee on Business and Economic Development, about Bill 24-454, the “Rediscover Equitable Central Occupancy Vitality and Encourage Resilient Yield (RECOVERY) Amendment Act of 2022. You can read her testimony below, or download a PDF copy.

Since the introduction of B24-454 in October of 2021, there have been some improvements in economic activity in the Central Business District (CBD). Office occupancy during the last week of October 2022 was at 40 percent—or 10 percentage points above the same week in October 2021.1 While economic activity at retail and grocery stores, restaurants, and transit stations have not fully recovered to their pre-pandemic levels, they have shown significant improvements through 2022.2 But unfortunately, these changes have not translated into improvements in the economic forecast of Downtown commercial office buildings:

- The office vacancy rate in the CBD now stands at 20.3 percent, up from 18.3 percent in the last quarter of 2021.3

- Net absorption has been continuously negative in the CBD since 2019,4 and the average time to lease has increased to over two years.5

- Higher interest rates have frozen the lending market for D.C. office properties. Institutional lenders (banks and insurance companies) are hesitant to lend on any D.C. office assets, and especially those assets with high levels of vacancy or those poised for development.

- There have been very few sales—a troubling sign—including a handful of distressed sales, which we expect to become more frequent. Some sales involve office to residential conversions, which is good news for downtown, but bad news for office market valuations.

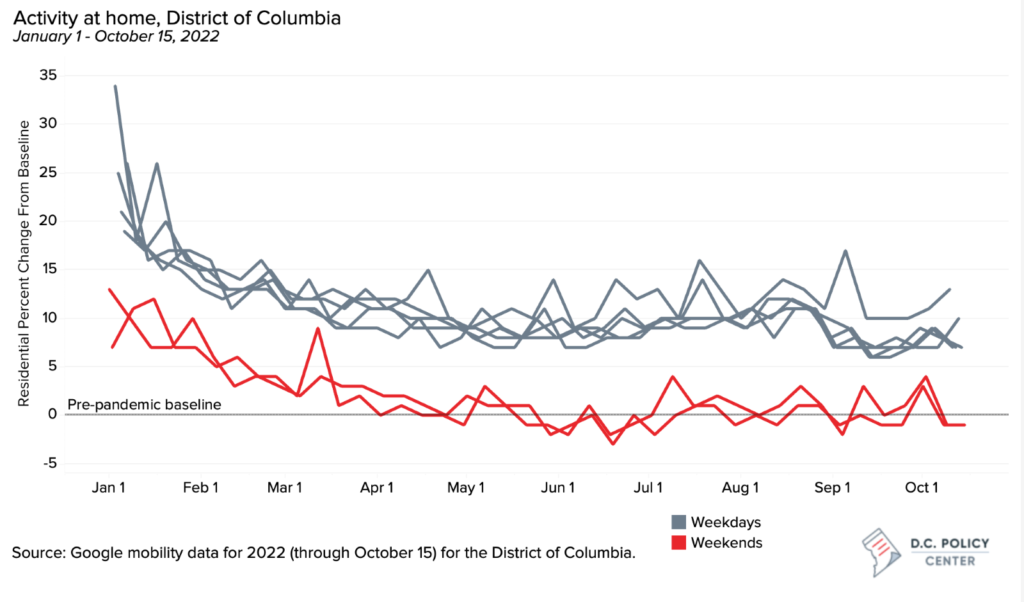

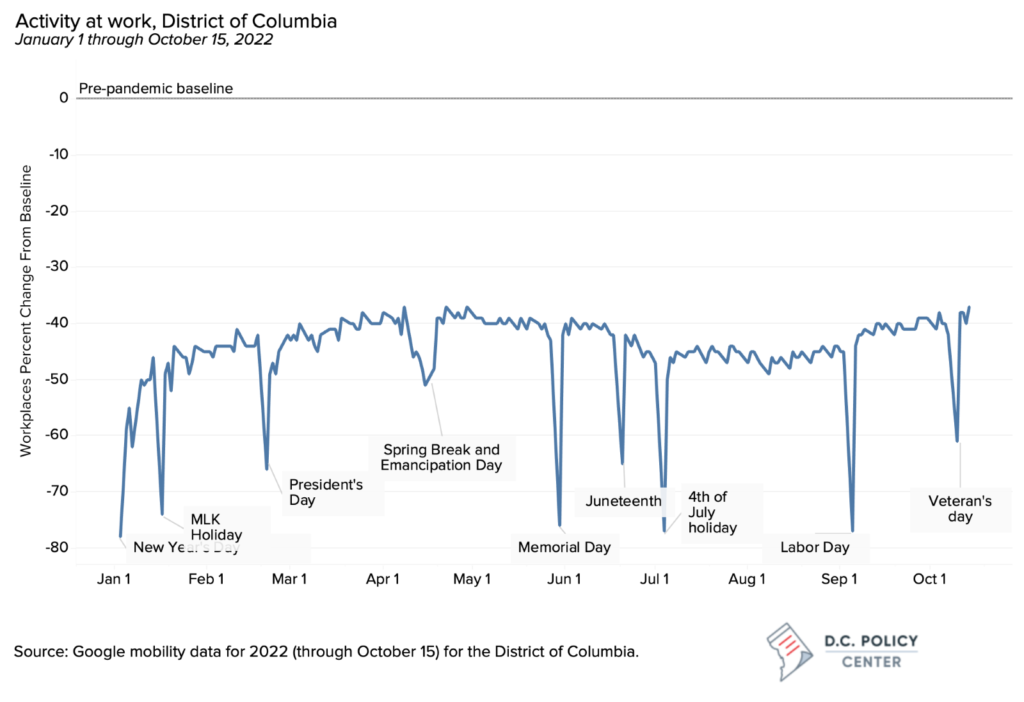

Empty office buildings are not any longer reflecting the need to stay home because of the pandemic. Since May of 2022, residents have been leaving their homes during the weekends at levels similar to the pre-pandemic period, but they are still not showing up in their offices during the week (See appendix figures).6 And the lack of demand for office space in the CBD, as well as the shift in institutional interest from high-cost cities like D.C. to secondary and tertiary cities,7 suggest that the markets are not expecting a swift reversal of remote work trends.

This suggests that recovery in downtown D.C. will take a long time and require a significant shift in the use of space, away from commercial office buildings to other types of use: residential, retail, leisure and hospitality, or the kinds of sectors that typically depend on workers consistently showing up for work. In this context, Bill 24-454 adds to the existing artillery that the District has already put in place to reshape and revitalize Central Business District areas.

Bill 24-454 offers a three-pronged approach to revitalize the CBD: Real property tax abatements and the transfer of tax exemptions for conversion projects, operating grants that are the equivalent of the sales and use taxes paid to businesses that relocate in the CBD areas (or landlords who lease space to such businesses and provide benefits such as rent abatements or tenant improvement allowances that is at least twice the size of the grant), and sales tax abatements to startup businesses in biotechnology and information sectors. This is a comprehensive approach that should be applauded.

I have two recommendations for this Committee’s consideration on this bill. First, I encourage this Committee to use the same comprehensive approach in the awarding of these public funds. Rather than using these three approaches separately, the city could consider using them in combination, incentivizing coordinated bidding for public dollars that take advantage of all three. This could result in comprehensive proposals that combine residential, office, and retail use, creating clusters of economic activity.

Second, I encourage this Committee to reconsider some of the requirements built into the bill for inclusive recovery. While conditioning public dollars to achieve certain social goods is expected, some of the requirements in the bill will reduce the efficacy of those public dollars. For example, the use of Project Labor Agreements has been shown to increase construction costs by 10 to 20 percent and could make the programs proposed by this bill less attractive. Similarly, the requirement that certain abatements are available to start-ups that take space that has been vacant for more than six months seems arbitrary. Property owners with persistently vacant space have it in their interest to offer attractive rates and new tenants in promising sectors should not be limited to space that has been chronically vacant.

This bill is important not just because of what it is trying to do, but because it shines a bright light on the fiscal risks the city is facing because of the pandemic. The continued loss of commercial value without an obvious means of shifting tax burdens elsewhere will further erase the District’s tax base. The next legislative session will bring along other types of fiscal distress: for example, the loss of ARPA dollars beginning next year will shrink the District’s fiscal space. In this context, economic revitalization, and making the District competitive and attractive to residents, businesses, and workers alike, should be the number one priority for the city.

Endnotes

- Kastle data.

- For example, activity in retail stores stood at 26 percentage points below pre-pandemic baseline in October of 2022 compared to 58 percent in January; activity at transit centers stood 34 percent below pre-pandemic baseline in October compared to 69 percent in January per Google mobility reports for D.C.

- CBRE Q3 2022 Market Report.

- According to JLL Q3 2022 market report, the year-to-date net absorption in the CBD and East End submarkets was (174,763) and (391,485), respectively.

- CoStar.

- Google mobility reports.

- AFIRE International Investor Survey, 2022