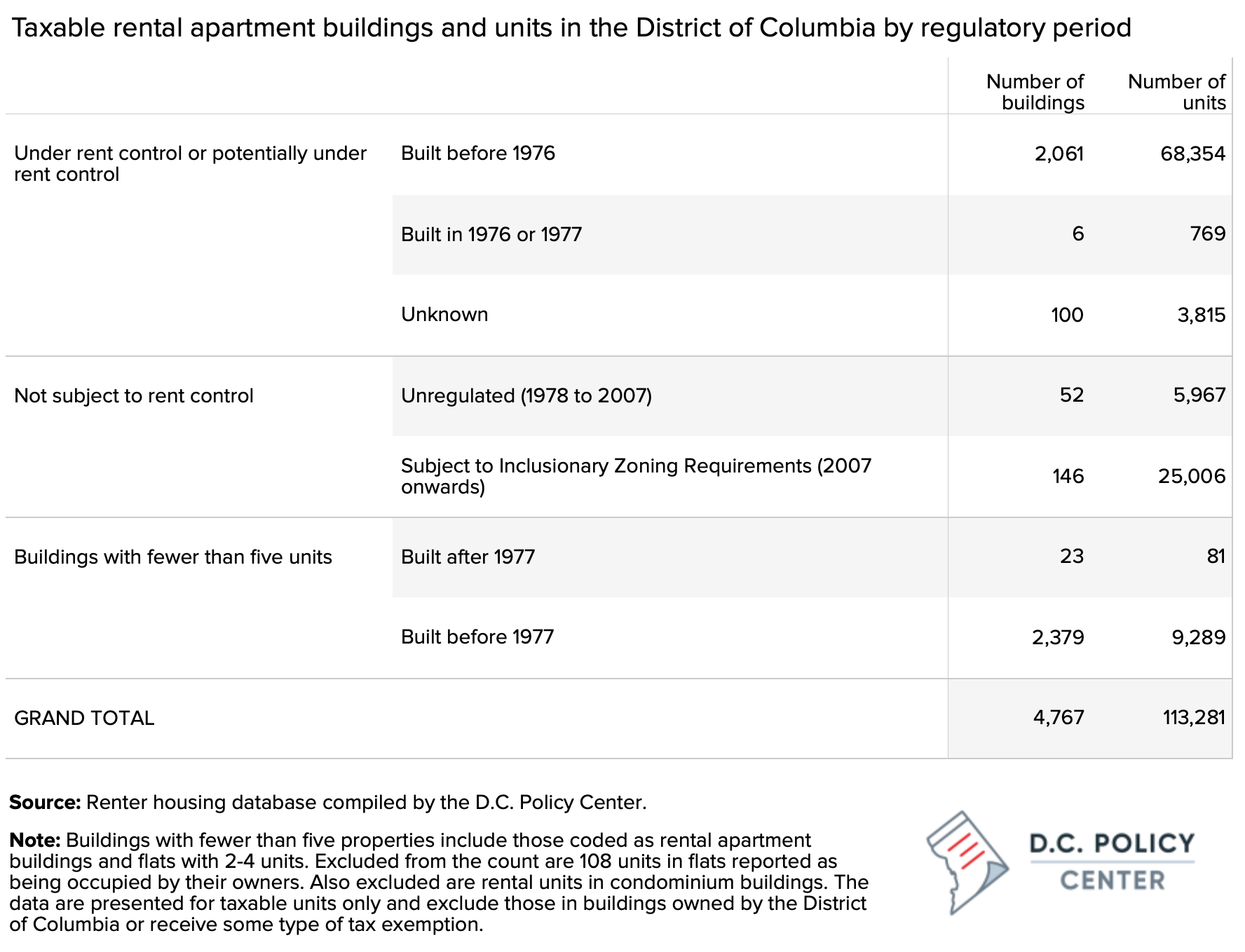

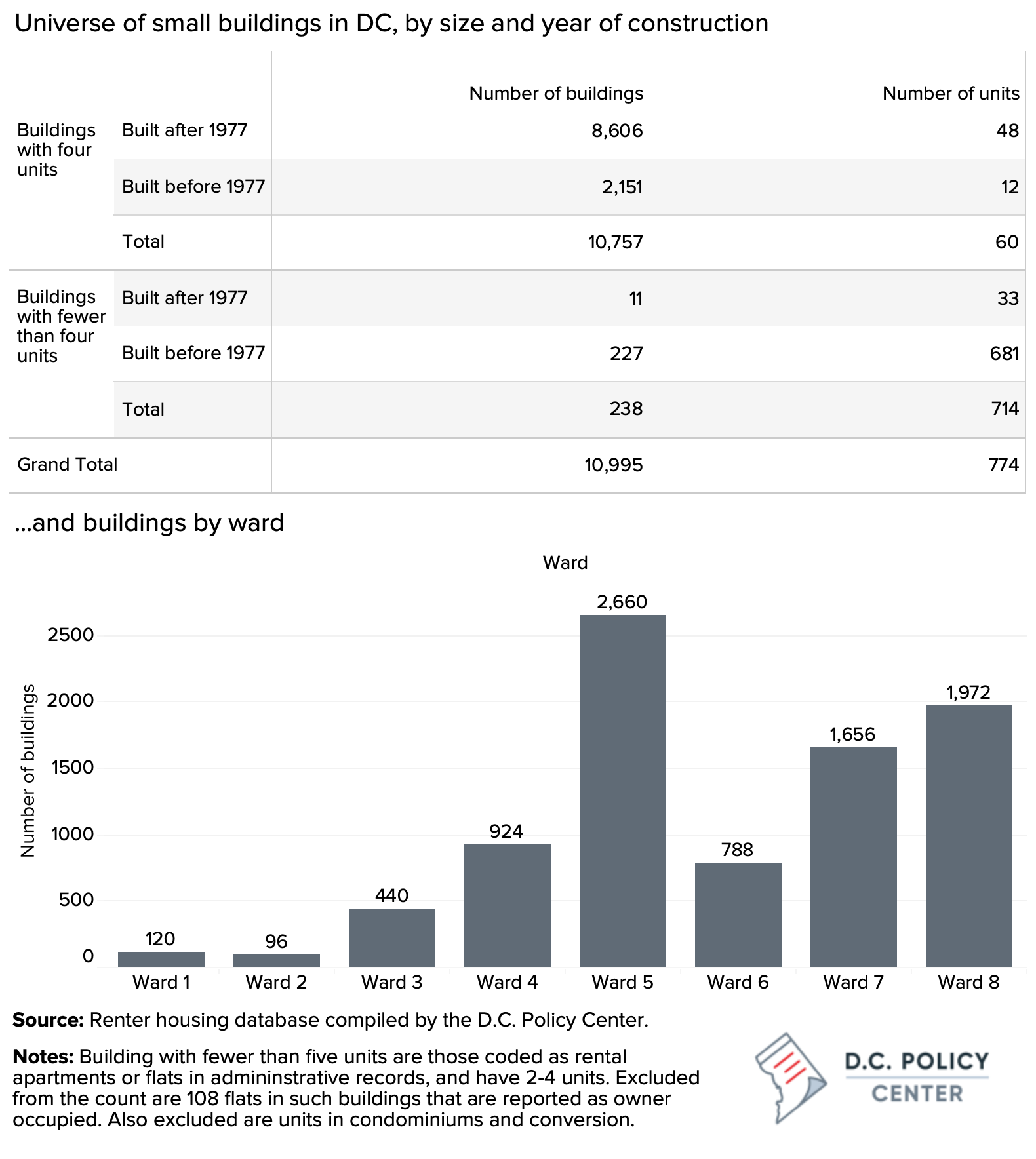

At present, the District has an estimated 113,281 rental apartment units in 4,767 taxable buildings. An estimated 72,878 units in 2,157 buildings are already subject to rent-control.[1] An estimated 31,980 units in 198 large buildings built after 1977 are currently exempt from rent control. But only 52 of these buildings are completely unregulated. Approximately 146 buildings built since 2007 (25,000 units) are subject to inclusionary zoning requirements. Finally, an estimated 9,370 units are in 2,400 small buildings that have fewer than five units. [2] Most of these small buildings are old—built before 1977—but some are recent conversions from single-family units combined into a single building and then subdivided into multiple rental apartments. (Why these numbers are estimates?)

Changes to the exemption period

If adopted, B23-795 would change the exemption period for multifamily rental apartment buildings from those that obtained their building permits before 1976 to those that obtained their building permits in the last fifteen years.

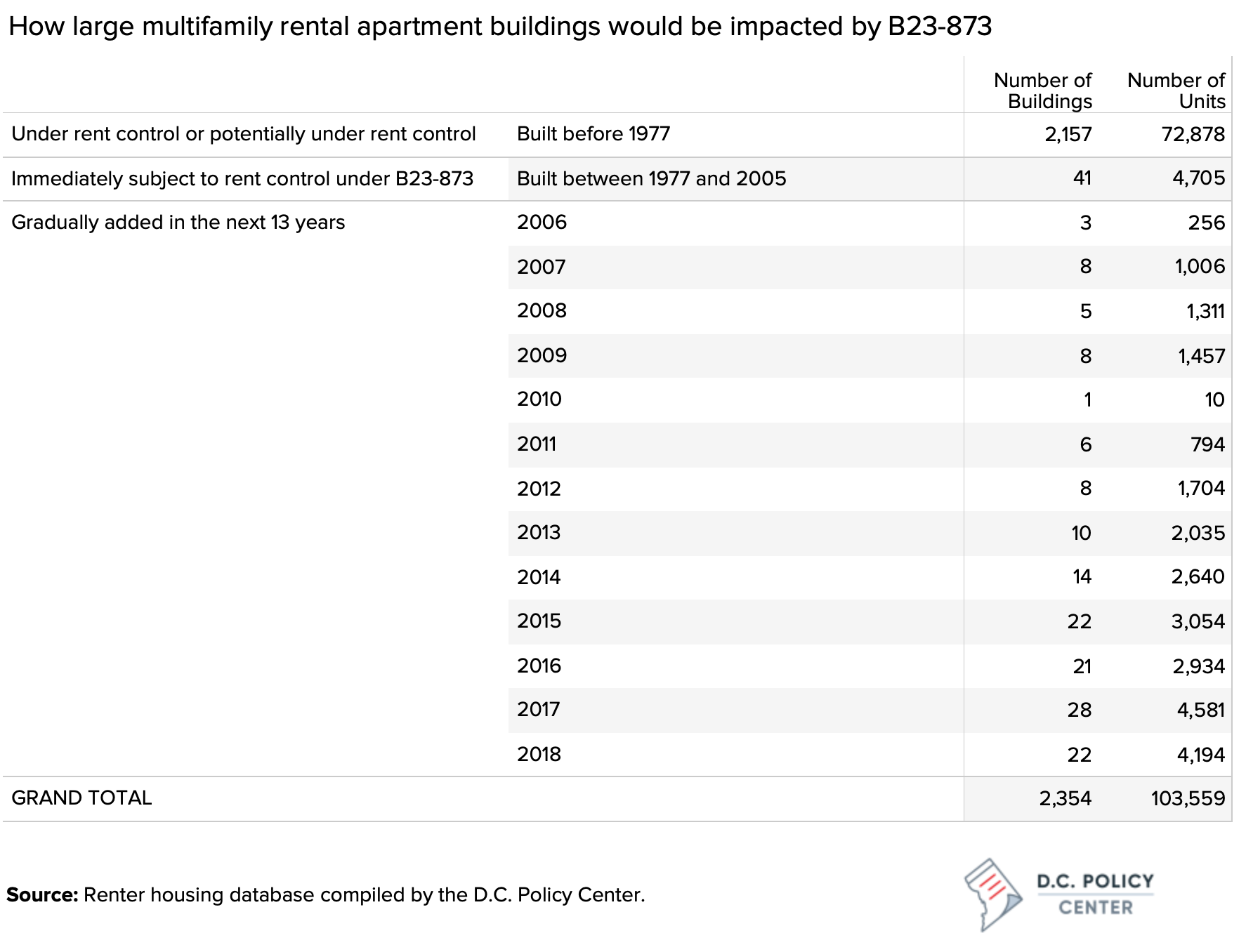

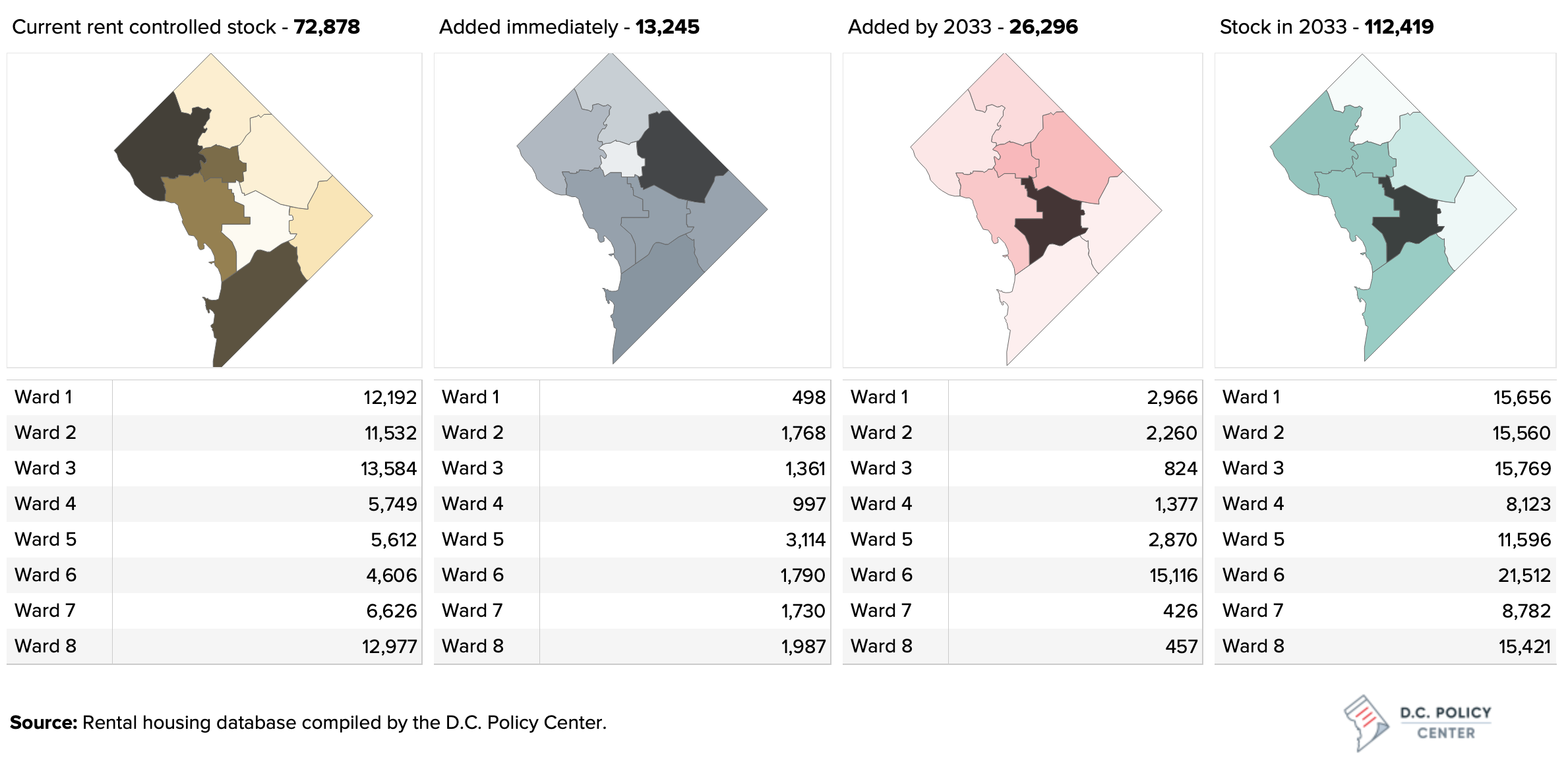

We estimate that upon adoption, B23-795 would immediately apply to 41 multifamily rental apartment buildings (with five or more units) with 4,705 units, increasing the rent-controlled stock by about 6.5. This relatively small number reflects the low level of construction activity in the city between 1977 and 2005. More than a of third of these 4,705 units are in Ward 2 and one-fifth each are in Wards 3 and 6.

Over the next fourteen years, 157 more buildings with 25,006 units would gradually become subject to rent-control. The growth will be slow at first and increase in pace in 2028 (when units built after 2012 begin losing their exemptions) by adding 10 or more buildings containing 2,000 to 4,000 units each year. If all of these buildings remain as rentals, by 2033, the number of rent-controlled units in large buildings could reach 103,559 (a 42 percent increase from its current level).

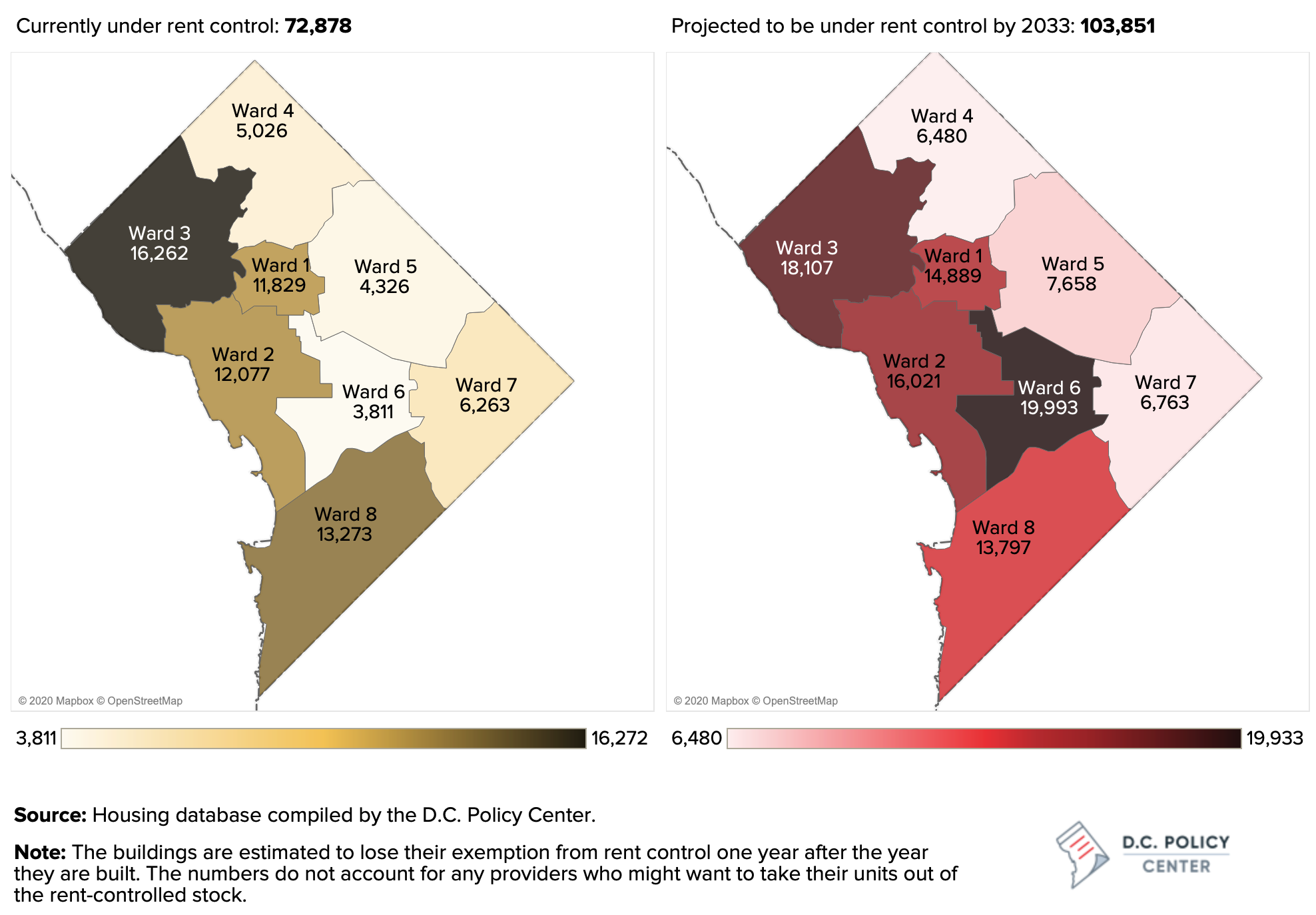

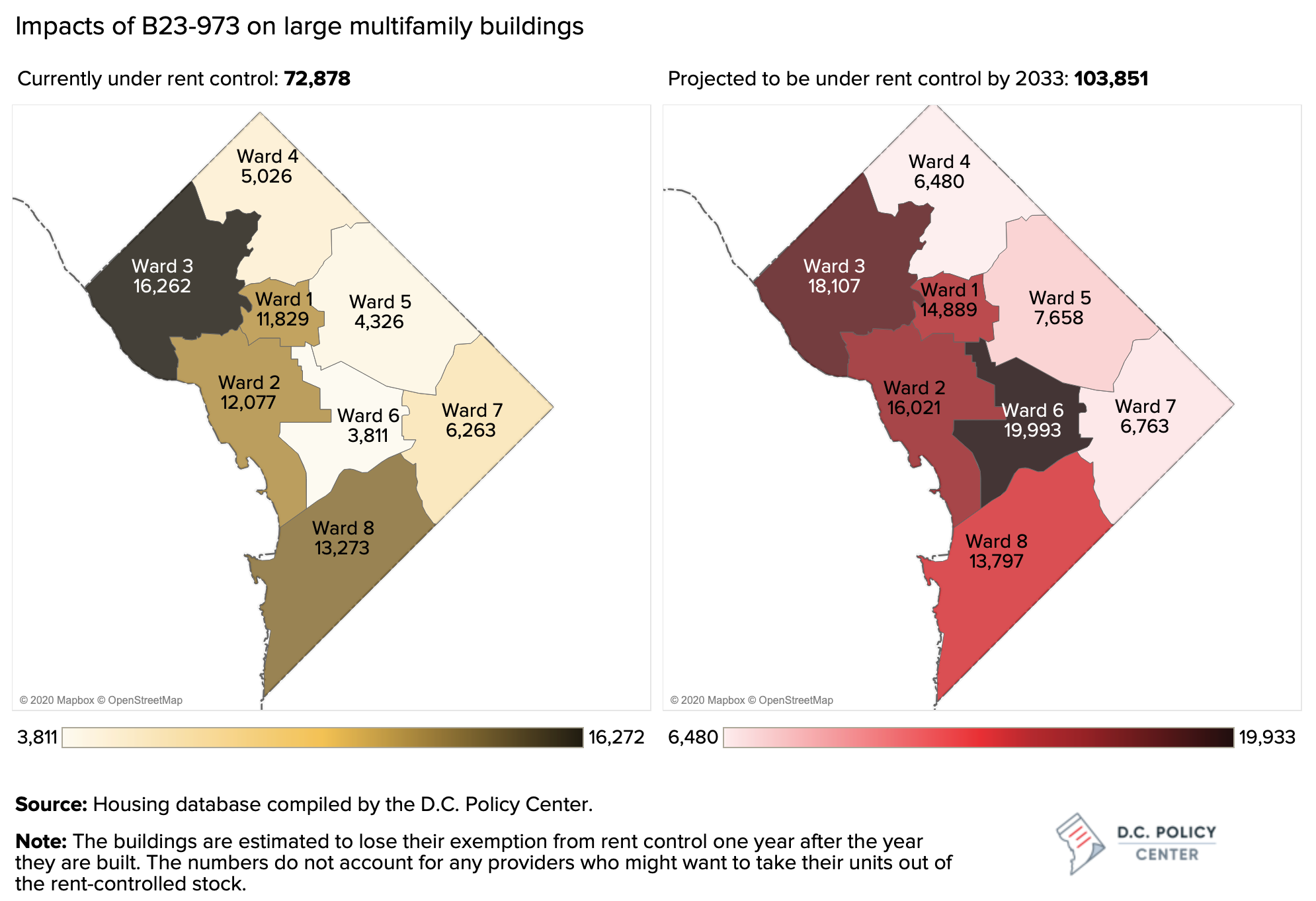

Limiting the exemption period to fifteen years would have different impacts in different parts of the city. The most dramatic shifts would take place in Ward 6, which has been the center of new multifamily apartment development in the city since 2005, reflecting the transformative changes that happened first in NoMa, Mount Vernon Triangle, and the Navy Yard, and later around the H Street Corridor, and the Southwest Waterfront. At present, Ward 6 accounts for only 5 percent of the rent-controlled stock. In contrast, 58 percent of units in multifamily apartment buildings constructed since 2005 are in Ward 6. By 2033, when all these units would become subject to rent control, Ward 6’s share of rent-controlled units could be the largest of any ward, at 19 percent, followed by Ward 3 at 17 percent. Ward 4 would have the fewest number of rent-controlled units by 2033, accounting for only 6 percent of the rent-controlled stock by that year .

Changes to minimum number of units

An estimated 9,370 rental units are small buildings with fewer than 5 rental units. These units are currently exempted from rent control. B23-874 would limit the exemption to providers with three or fewer units.

We estimate that limiting the exemption to buildings with fewer than four units would impact 2,164 buildings with 8,656 units. Almost all these units would immediately be subject to rent control since small rental apartment buildings are typically built before 1977. [3] Ward 5 alone accounts for more than a quarter of the units that would be immediately subject to rent control under B23-873. Wards 7 and 8 would also see substantive increases, with over 1,500 units each, whereas the inclusion of properties with four units would make almost no impact in Wards 1 and 2 .

Overall impact

When put together, the more restrictive exemptions would immediately expand the stock of rent-controlled units by an increment of 13,500 units to 86,123 upon the implementation of B23-873. The immediate impacts would largely be driven by the expansion of rent control to small buildings with four units. Ward 8 would have the largest number of rent controlled units, and Wards 5 would have more rent-controlled units than Ward 7.

By 2033, the city’s rent-controlled stock would expand to 112,419 units. The distribution of these units would also change considerably—as years pass, the rolling 15-year window would capture more of the city’s recent development, which has been especially strong in Ward 6. By 2033, the number of rent controlled units in this ward would be more than five times the number today.

The dramatic increase in the number of rent-controlled units in the recently built Class A buildings in Ward 6 highlights that the beneficiaries of expanding rent control would be the tenants living in these buildings, and not necessarily the lower income households in the city.

The actual number of rent-controlled units, however, could be much fewer than what is projected here. Some units would leave the rent-controlled stock through condominium conversions; other units might become unavailable if reduced operating incomes make it difficult to keep them habitable. The District’s rent-controlled stock has shrunk by about 30 percent since the adoption of the Rental Housing Act for these very reasons. In fact, with more restrictive rents, B23-873 could further increase the leakage rate out of the rent-controlled stock. We revisit this issue in Part V.

<< Back: Main publication page | Next: Impacts on valuations and tax revenue>>

Notes

[1] This is the equivalent of all 57 percent of all rental apartment units, 35 percent of all rental housing (including the “shadow rentals”), and 23 percent of all housing in the city.

[2] This estimate is based on the number of units in flats and conveersions in residential apartment buildings coded as those with fewer than five units. The tax database describes them as units under one roof, converted from apartment buildings (flats) or single family homes (conversions) into multifamily use.

[3] This estimate is entirely driven by the building size and does not include owners with four units in disparate buildings because we cannot provide a reliable estimate for owners with units in disparate buildings. Our best estimate for this group is approximately 560 units owned by 140 separate providers. But there is a lot of uncertainty regarding this estimate because we only know the registered name of the owner which could be an LLC whereas the rent control laws apply to natural persons.