Why are the numbers presented in the study estimates?

Three sources of uncertainty make it difficult to know exactly how many units exist in multifamily buildings, and how many are subject to rent control.

First, we do not have full administrative records on the number of units in multifamily apartment buildings and this information must be compiled using multiple resources. This is because, unlike condominium buildings and conversions, where each unit is registered separately for tax purposes, rental apartment buildings (and coops) have a single entity that owns the entire building. The number of units are sometimes reported in the Computer Assisted Mass Appraisal database, and sometimes they are not. Step-by-step details of these calculations can be found here.

Second, we do not have full administrative records on the date when a building has received its building permit, making it difficut to determine whether a building is subject to rent-control laws. The tax assessment records are missing the Actual Year Built (AYB) data for 99 multifamily rental apartment buildings which account for an estimated 3,810 units. We include these in the rent-controlled stock as noted in Table 3.

Third, we have little information on the landlords who own units in disparate buildings including condominium buildings. An analysis of the District’s rental stock in condominiums, conversions, and flats (not including rental apartment buildings with five or more units) shows that this number is possibly small. We could find 130 such small landlords that collectively own about 1,520 units that are subject to rent control. This estimate is obtained by grouping units owned by the same owner (as trascribed in the tax rolls) in buildings with the appropriate use code (residential flats, condominiums and conversions), and only includes propoerties that do not receive a homestead exemption.

What are the other five proposals considered by the DC Council consideration?

Five other bills offer more limited in the changes to the rent control laws.

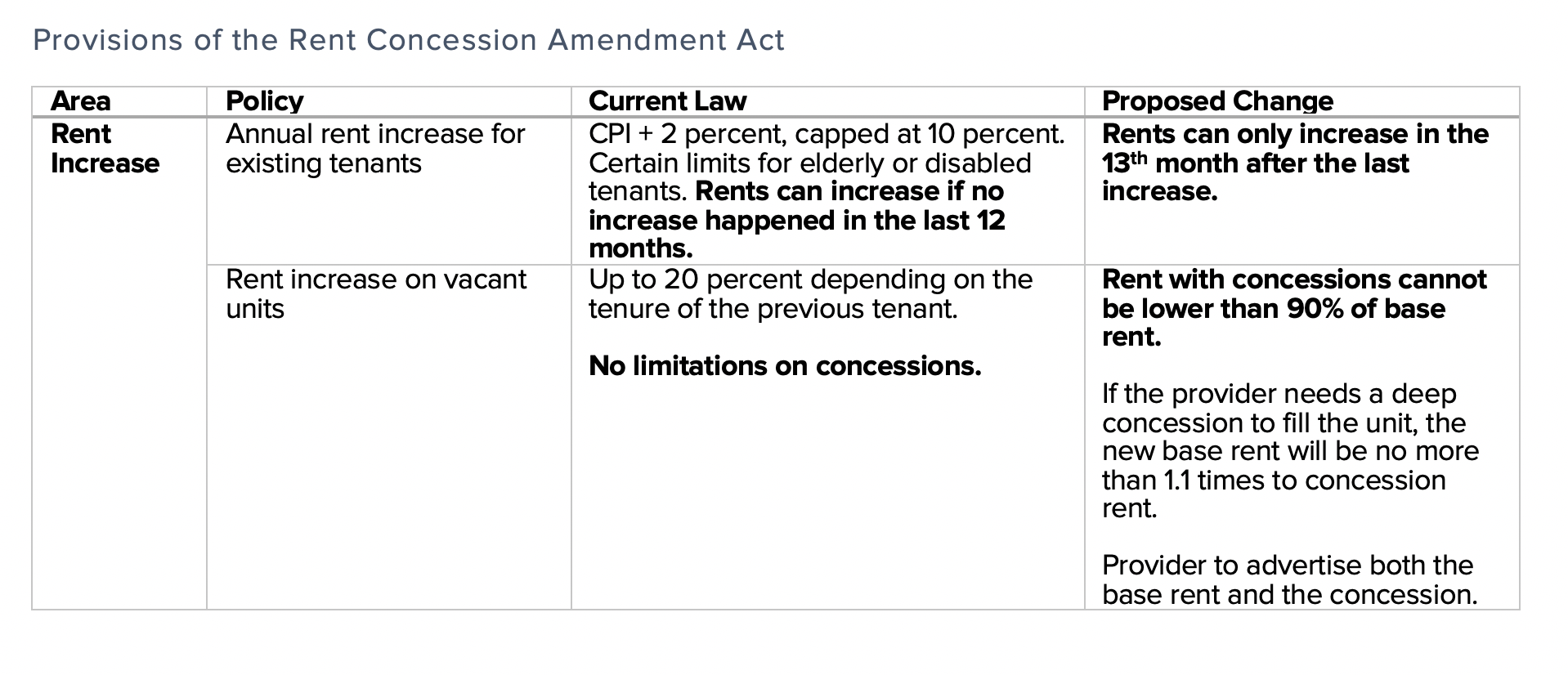

Bill 23-237, the Rent Concession Amendment Act of 2019 requires that when advertising a unit, the housing provider must disclose the base rent, the surcharges, and when offered, the discounts on the rent for an introductory period, commonly known as concessions. The goal of the legislation is to ensure that the tenants have full knowledge of the base rent they would have to pay when their discount period is over. The bill also states that a discounted rent offered to a new tenant cannot be less than 90 percent of the base rent.

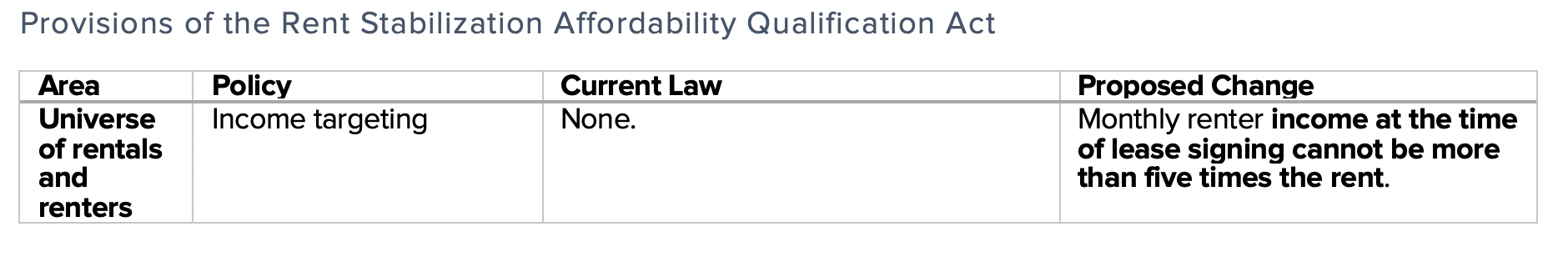

Bill 23-530, the Rent Stabilization Affordability Qualification Amendment Act of 2020 implements income limits on tenants who are eligible to rent from the rent-controlled stock. At present, there is no income test or verification requirement for tenants in rent-controlled units. Under the proposed bill, a tenant would be eligible to rent a rent-controlled unit only if the tenant’s monthly income in the previous calendar year was 5 times or less the monthly rent.

Bill 23-530, the Rent Stabilization Affordability Qualification Amendment Act of 2020 implements income limits on tenants who are eligible to rent from the rent-controlled stock. At present, there is no income test or verification requirement for tenants in rent-controlled units. Under the proposed bill, a tenant would be eligible to rent a rent-controlled unit only if the tenant’s monthly income in the previous calendar year was 5 times or less the monthly rent.

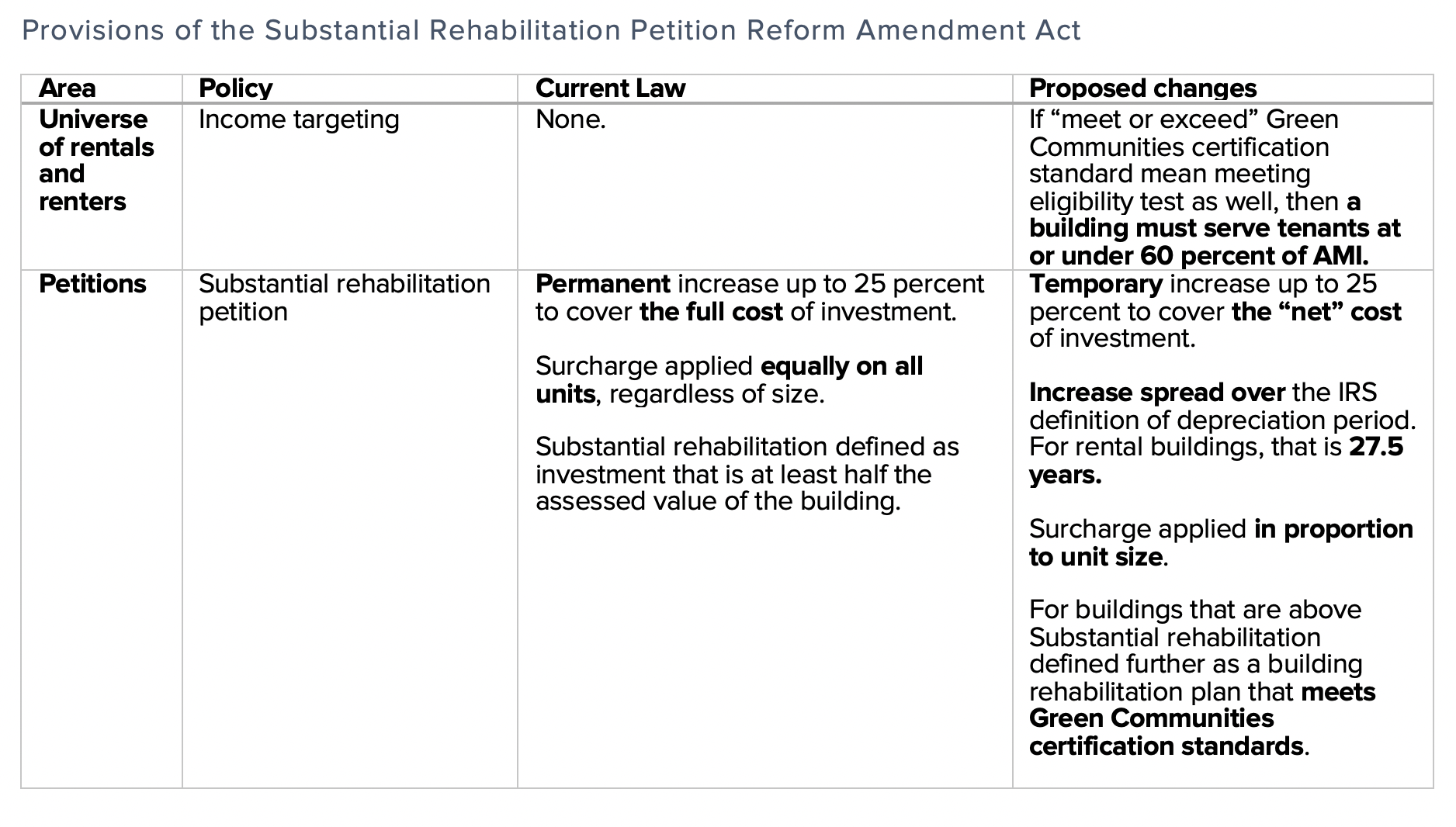

Bill 23-877, the Substantial Rehabilitation Petition Reform Amendment Act of 2020, limits the duration for which a housing provider can implement surcharges to cover the cost of a substantial rehabilitation to the period of amortization as determined by the Internal Revenue Service rules for residential properties. (The depreciation period for rental property under IRS rules is 27.5 years.) Under the bill, the net cost of the rehabilitation is calculated by subtracting from the cost any operating cost savings the landlord might experience as a result of the rehabilitation (for example by installing an efficient heating or cooling systems) and the costs are distributed to tenants proportional to the size of their units. Under current law, the rent surcharges under substantial rehabilitation petition are permanent, and the surcharges do not account for the cost savings from rehabilitation.

Bill 23-877, the Substantial Rehabilitation Petition Reform Amendment Act of 2020, limits the duration for which a housing provider can implement surcharges to cover the cost of a substantial rehabilitation to the period of amortization as determined by the Internal Revenue Service rules for residential properties. (The depreciation period for rental property under IRS rules is 27.5 years.) Under the bill, the net cost of the rehabilitation is calculated by subtracting from the cost any operating cost savings the landlord might experience as a result of the rehabilitation (for example by installing an efficient heating or cooling systems) and the costs are distributed to tenants proportional to the size of their units. Under current law, the rent surcharges under substantial rehabilitation petition are permanent, and the surcharges do not account for the cost savings from rehabilitation.

Further, to be able the charge a surcharge, the bill requires that rehabilitation projects for over 10,000 sq. ft. gross area meet or exceed the Green Communities certification standards—a set of requirements on the design, construction, and operation of multifamily buildings that contain affordable housing units. To be eligible to receive certification, rental apartment buildings must serve residents at or below 60 percent of Area Median Income. The bill does not require that the provider receives Green Communities certification but leaves it up to the Rent Administrator to make that determination.

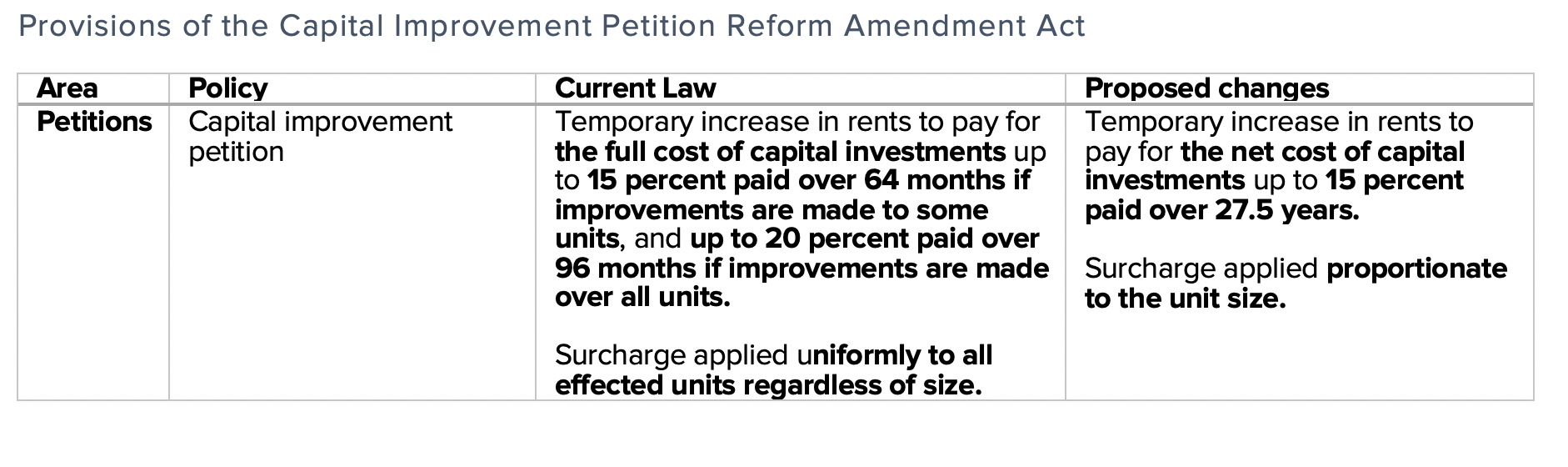

Bill 23-879, the Capital Improvement Petition Reform Amendment Act of 2020 similarly imposes limits on how much landlords can recoup, and over what period, if they invest in capital improvements that are not large enough to qualify as “substantial rehabilitations.” The bill specifically directs the housing providers to spread the cost of capital improvements over 27.5 years, thereby reducing the temporary surcharge they can impose on the rent. Further, it caps the rent increases to 15 percent, and requires that the surcharges be applied in proportionate to unit size.

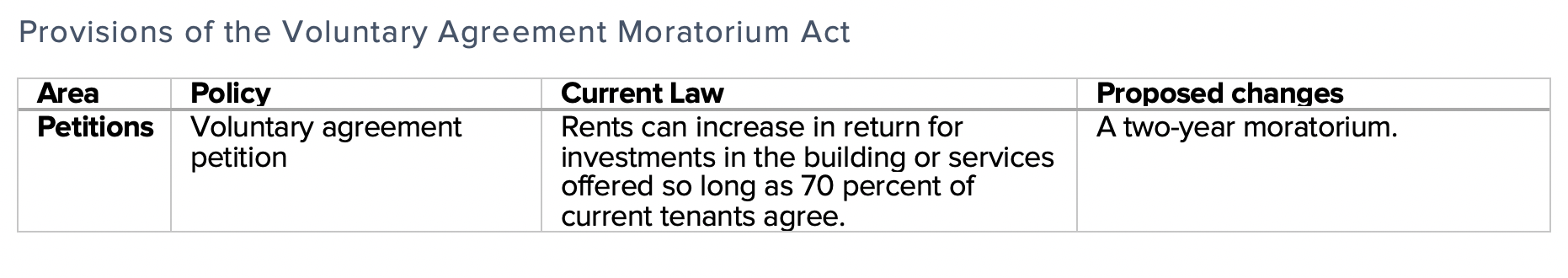

Bill 23-878, the Voluntary Agreement Moratorium Act of 2020 proposes a 2-year moratorium on voluntary agreements.

<< Back: Main publication page