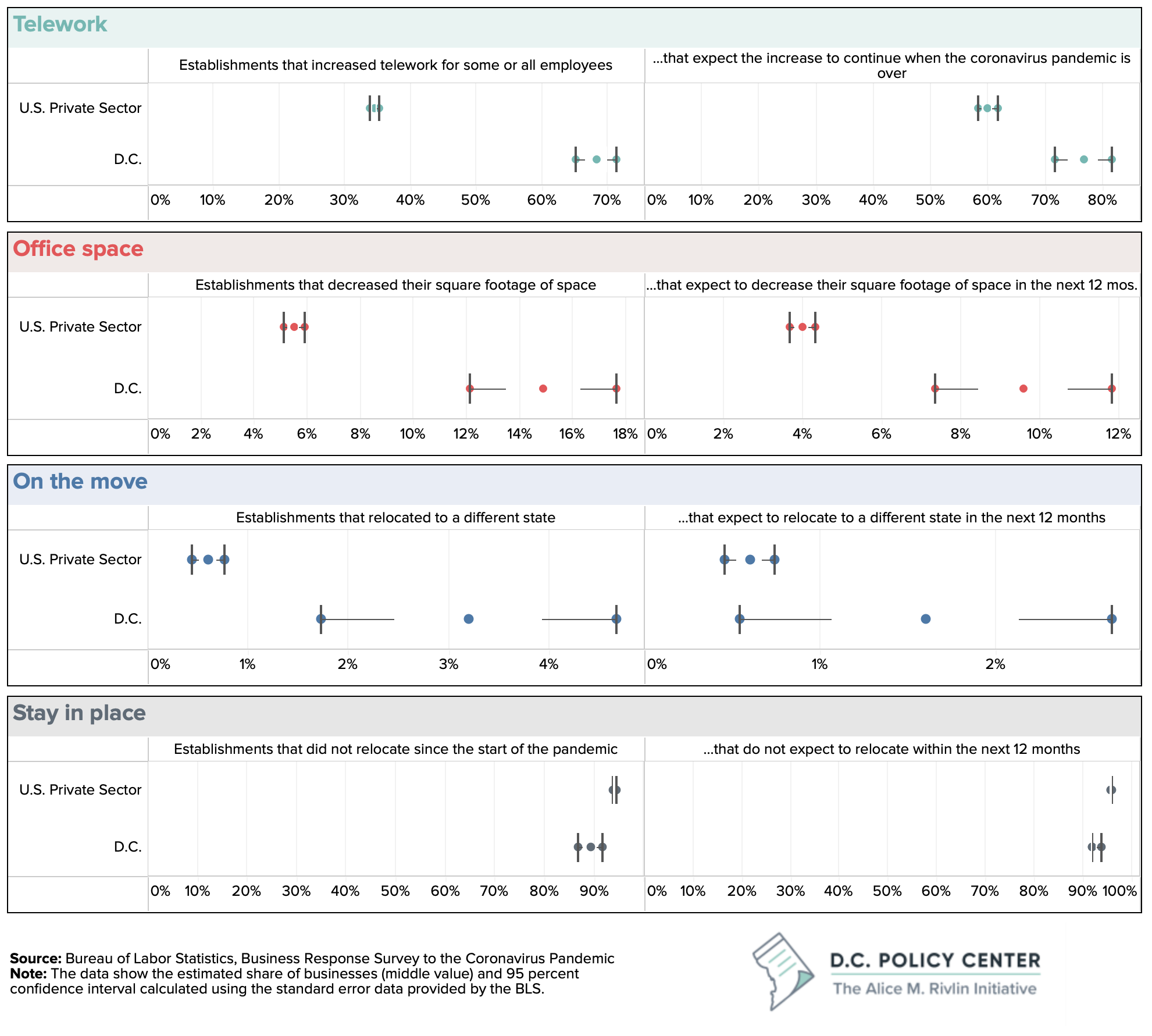

Data released by the Bureau of Labor Statistics based on a survey of businesses across the country show that a larger share of private sector businesses in D.C. adopted telework, reduced their office space, and moved their offices, compared to the private sector establishments across the entire U.S.

Across D.C., 68 percent of business establishments increased telework for some or all of their employees—nearly double the share observed across the private sector establishments in the entire country (35 percent). These establishments accounted for nearly 80 percent of all private sector employment in D.C., compared to 51 percent across the country (not shown in the graph). And a larger share of establishments expect to continue increasing telework practices in D.C.: 77 percent of the establishments in D.C. forecast more teleworking, compared to 60 percent across the country.

D.C. establishments have also been quicker to shrink their office footprints: 15 percent of District establishments report reducing their square footage since the beginning of the pandemic, compared to 6 percent across the country. And another ten percent expect to do so in the next year, compared to 4 percent across the country. This information corroborates our recent finding that commercial property values could further decline because of future increases in vacancy rates.

A larger share of establishments moved out of the District to a different state (3 percent) compared to the share of establishments that changed states across the entire country (under 1 percent). This translates into 975 business establishments. This is an area where comparing D.C. to other states could be tricky since a rather a short-distance move can land an establishment in a different state or jurisdiction in our region. But it also highlights the competitive pressures the city faces as a small, administratively separate jurisdiction in the middle of a large, fractured, but competitive metropolitan area.1

Another way to think about the relocation issue is to examine establishment decisions to remain in place. In D.C., 89 percent of the establishments have stayed in their current location, compared to 94 percent across the entire nation. And a smaller share of D.C. establishments plan to remain in place compared to the entire nation.

Finally, within city moves are also more common in D.C. compared to the U.S.: 7 percent of private sector establishments moved within the city in D.C., compared to 4 percent of establishments that moved within their city or county across the country. This, perhaps, explains why the space reduction has been more pronounced in D.C.—that establishments are more mobile. Similarly, a larger share of establishments plans to move somewhere else within the city in D.C. in the next year compared to the entire nation (4.4 percent v. 2.7 percent). While these establishments want to stay in the city, the District is at risk to lose them if nearby jurisdictions offer better value.

These data suggest that telework will likely expand in the coming year and continue breaking down the relationship between where people live and where they work. And these data are important because they show employers have adjusted their expectations to plan for a future where an increasing share of employees work remotely. And this affects how they hire, where they locate, and how much office space they take. So far, trends are working against cities that are large employment districts, like the District of Columbia.