Recently, the D.C. Policy Center’s Rivlin Initiative finished the second round of the Quarterly Business Sentiments Survey. The survey’s goal is to provide systematic, comprehensive information on the business community’s experiences to elected officials, the media, and the public.

In the second round, 411 respondents completed the survey.[1] The vast majority of those who participated were owners or executives from small, established businesses. Over 80 percent of respondents came from businesses with 20 employees or fewer, and a little over 45 percentcame from businesses that have been in operation for over a decade.

Compared to the first round, respondents came from a wider range of businesses. 22 percent of respondents came from the professional, scientific, and technical services sector, 12 percent came from real estate, 10 percent came from the nonprofit sector, and 9 percent came from health care.

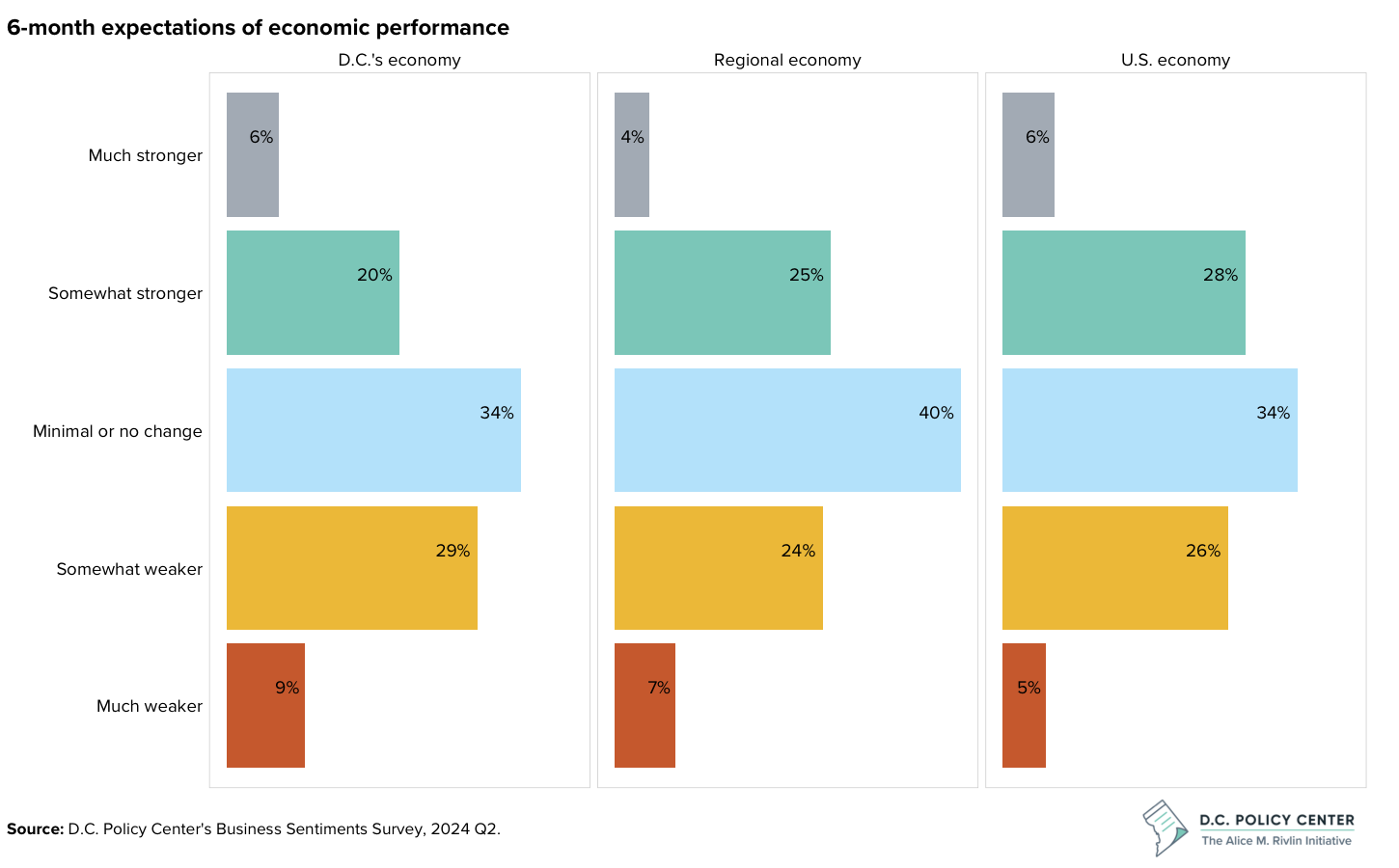

Survey participants were asked about their 6-month expectations for the D.C. economy, the regional economy, and the national economy. While the sentiments reported here may not be representative of the opinions of the region’s business community, the results fit with recent economic data.

Round-two respondents had more bullish expectations about the D.C. economy than round-one respondents. In round one,over 70 percent of respondents expected the D.C. economy to be “somewhat weaker” or “much weaker” in the next six months. In round two, as the chart above shows, only 38 percent of respondents expected the D.C. economy to be “somewhat weaker” or “much weaker.”

What accounts for this change in expectations? It is likely a function of the fact that the real estate sector occupies a smaller portion of the round two survey sample. Compared to respondents who are not in real estate, respondents from the real estate sector had much dimmer expectations about the District’s economy. These gloomier expectations likely stem from the fact that D.C.’s commercial real estate sector has faced substantial challenges since the pandemic.

But like first-round respondents, round-two survey respondents are more pessimistic about the D.C. economy than the national economy. Recent economic data helps place these expectations in context. Between January 2023 and March 2024, total nonfarm employment grew by 2.2 percent in the United States. By contrast, nonfarm employment in D.C. grew by 0.7 percent. In fact, since the COVID-19 pandemic, D.C. has largely lagged the national economy in total nonfarm employment growth.

[1] Responses may not sum to 100 percent because some respondents might have skipped the question.