Rising rents in the District of Columbia, along with increased pressure on rental housing from higher income renters, have led to a debate on whether to expand rent control provisions in the city. In July of 2020, the D.C. Council voted to retain the city’s rent control laws (expiring at the end of 2020) for another ten years without any changes. Since then, at least six legislative proposals have been introduced in the Council offering various modifications to the law. Five of the six bills make changes to different sections of the rent control laws, including means-testing tenants, or limiting how providers can increase rents when they make improvements to units or the entire building. The sixth proposal, which is based on the policy positions of the “Reclaim Rent Control” platform, offers sweeping changes including a potentially-significant expansion of the rent-controlled stock, stricter restrictions on how rents can be increased from year to year, and various limitations to the petition processes housing providers use to raise revenue for investments in their buildings.

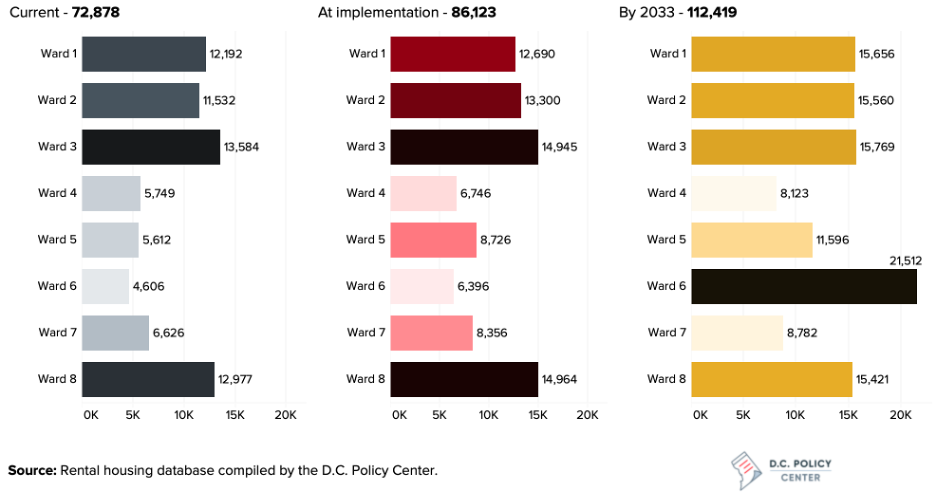

This policy brief offers an analysis of, Bill 23-873, the Rent Stabilization Program Reform and Expansion Amendment Act of 2020.[1] We focus on this bill because it offers the most profound changes to the District’s rent control laws, while including many of elements of the other five bills the Council is considering.[2] We examine the potential impact of the bill on the size of the rent controlled stock, rents, building valuations and tax revenue. We also discuss the implications on the bill for the entire housing ecosystem and its future.

Part I of the brief provides a summary of the key provisions of the current rent control laws in D.C. Part II provides a comparison of B23-873 to the current law. Part III examines how the landscape of rent-controlled housing would change in the event of the implementation of the bill and during the fourteen-year period that would follow. Part IV examines rent growth under the provisions of the bill and the implications on building valuations and tax revenue. Part V discusses potential implications of an overly restrictive rent-control system on the overall health of the housing market and affordability. Part VI concludes with a discussion of policy options for the city.

<< Back: Main publication page | Next: What are the provisions of the District’s current rent control laws? >>

Notes

[1] B23-0873 was introduced by Councilmembers T. White, and Nadeau on July 27, 2020 and has been referred to the Committee on Housing and Neighborhood Revitalization on September 22, 2020. A hearing on the bill has been scheduled for November 5, 2020.

[2] A summary of the other five bills can be found in the Appendix. The D.C. Policy Center’s analysis of the other five bills can be found here.