A recent Wall Street Journal analysis shows that across the country, rents in the suburbs and exurbs are rising at a much higher rate than their urban counterparts. The author ties this trend to pandemic-induced out-migration from cities to their neighboring suburban communities.

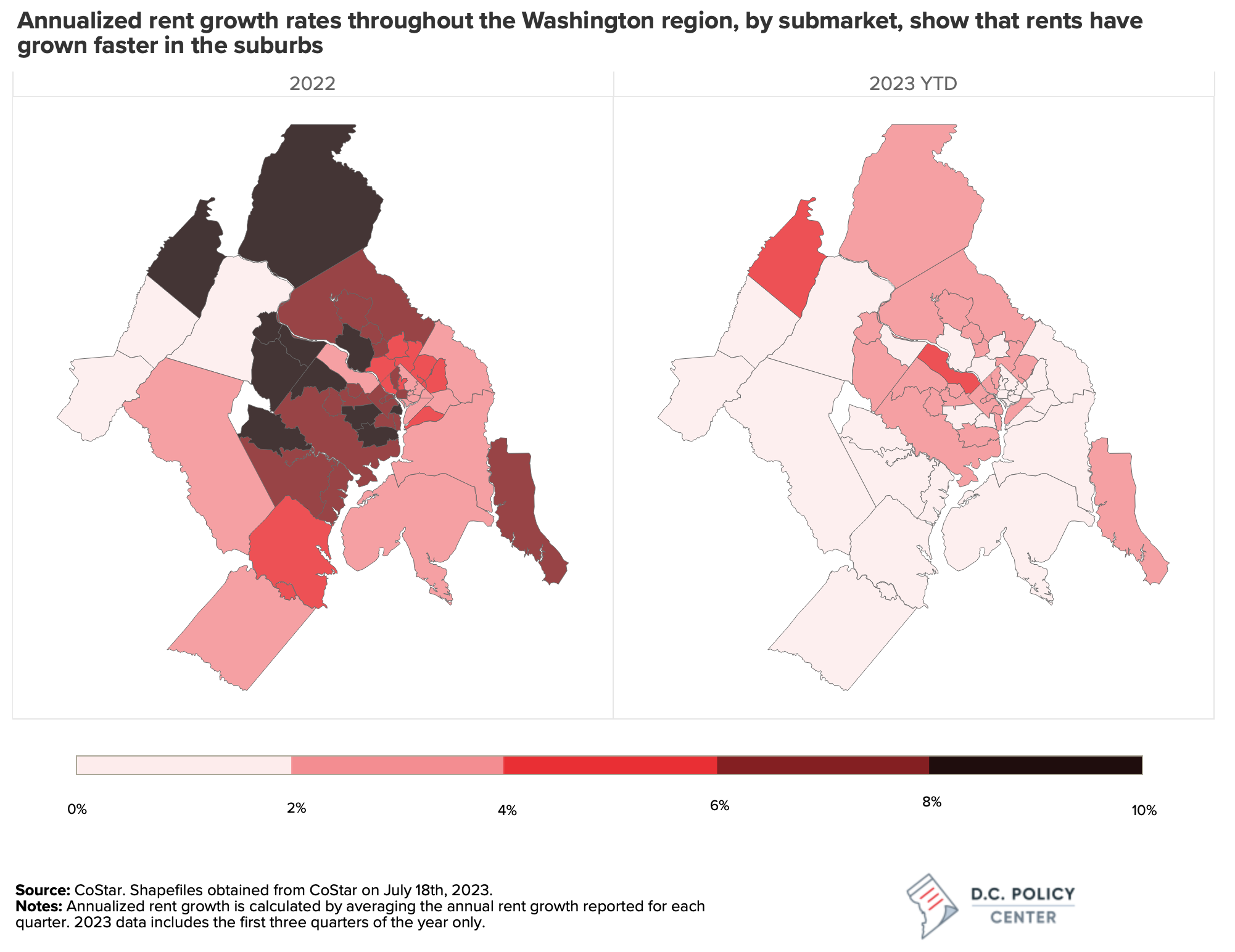

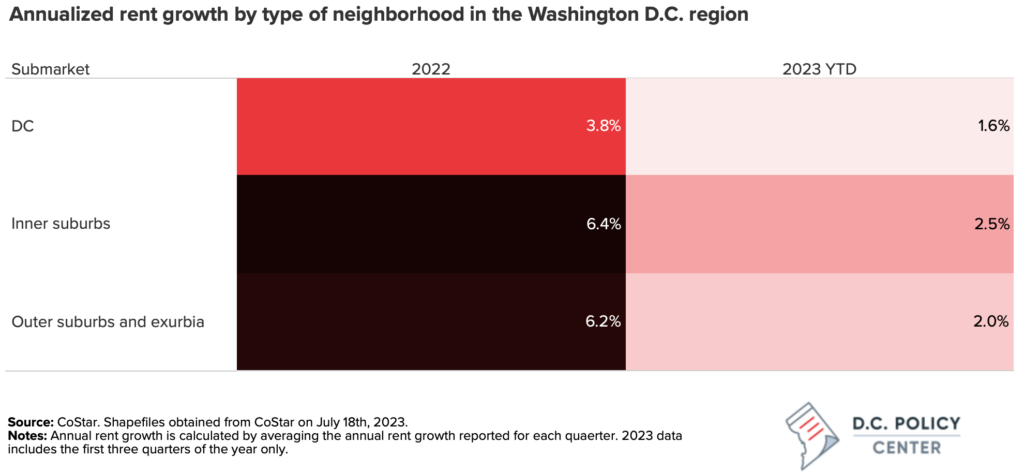

Wondering whether these trends held for D.C. and the surrounding region, we conducted a regional analysis of multifamily rental growth using data from CoStar. The data show that while rents have grown much faster in the surrounding exurbs and suburbs than in D.C. in 2022, rent growth has slowed down significantly across the board this year.

The data show that the inner and outer suburbs experienced the highest annualized rent growth rates in both 2022 and through the third quarter of 2023. This trend is most pronounced in 2022 when some areas saw rents increase by more than 10 percent. In both years, the District had a lower average annual rent growth rate compared to both the suburbs and exurbs.

Rent growth slowed down in 2023

Comparing annualized rent growth in 2023 (year to date) to 2022 shows that rent growth has slowed down significantly throughout the region. As a result, the differences in rent growth between each area have decreased this year compared to 2022. One possible explanation for this convergence is that during the period of out-migration from D.C. to the surrounding areas, demand far outpaced the available supply of units in the suburbs and exurbs putting a positive pressure on rents. D.C.’s Office of Revenue Analysis conducted research using data from the IRS showed that from the period between 2019 and 2021, there was a net loss of 16,429 residents. Furthermore, the authors found that the most popular destination for these movers was the region’s inner suburbs. Additionally, D.C. has had a much higher number of multifamily units in construction compared to the suburbs and exurbs for both years.

The investment in additional multifamily units in D.C. combined with the migration out of the city has helped suppress rent growth in the last year. Conversely, the growing demand for rental housing in the suburbs and exurbs pushed up rent growth. While we cannot be certain of the future, it appears that rents in the region could be converging if migration out into the suburbs and exurbs continues.

Data Notes

Data was collected from CoStar on July 18th, 2023 and maps were created using shapefiles of multifamily submarkets, provided by CoStar.

Neighborhood types and corresponding CoStar submarkets:

- D.C.

- Adams Morgan and Columbia Heights, Anacostia Southeast, Brightwood Fort Totten, Capitol Hill, Connecticut Ave Northwest, Downtown DC, Georgetown and Wisconsin Ave, H Street and NoMa, Lower Northeast; Southwest and Navy Yard.

- Inner Suburbs

- Alexandria and I-395, Annandale, Ballston, Bethesda, Branch Avenue, Capitol Heights and Largo, Fairfax City and Oakton, Falls Church and Vienna, Huntington and Springfield, Hyattsville, McLean and Great Falls, National Landing, Old Town and Potomac Yard, Potomac, Rockville, Rosslyn, Silver Spring and White Oak, Tysons Corner; Wheaton and Kensington.

- Outer Suburbs and Exurbs

- Ashburn and Sterling, Calvert County, Charles County, Clarke County, Dulles Greenway, Fauquier County, Frederick County, Fredericksburg, Gaithersburg, Greenbelt, Jefferson County, Leesburg, Manassas and Gainesville, North Prince George’s County, Outlying Arlington County, Outlying Fairfax County, Outlying Loudoun County, Outlying Montgomery County, Outlying South, Reston-Herndon Corridor, South Prince George’s County, Spotsylvania, Stafford County, Warren County; Woodbridge and I-95 Corridor.