This is the fourth part in a series chronicling the author’s family’s move back to D.C. Previously: Part 1; Part 2; Part 3.

Can we shoehorn our family of five into a two-bedroom apartment?

The question was first posed as a joke, responding to my perceived lack of enthusiasm for yard work. But as our search for a mid-price, Metro-accessible house inside Washington D.C. has so far resulted in less than ideal options, thinking of multiple-unit dwellings is an increasingly attractive option as we plan our July return to D.C. after spending two years in South Korea.

My wife is a Lieutenant Commander in the Navy and is about to start her next job at the Pentagon, a post known for lengthy days and no assigned parking. As I’ve written about previously, for a variety of reasons our long-term plan is to remain in Washington. Now we’re less than two months from moving, our excitement about being in D.C. is growing—but so too is our anxiety about finding a home.

Renting, we thought, would provide a gentle landing in D.C. We could resume our life in D.C. in a part of town we like most while relieving some of the pressure to find a house fast. Maybe we’d also build up some savings for an eventual purchase.

Plus, after spending the past two years living in South Korea’s very vertical second city of Busan (population about 4 million), we’ve become accustomed to apartment living. Granted, in D.C. we’re unlikely to replicate our current 2,000 square-foot apartment with in-unit washer and dryer, garage parking for two cars, and a view of the East Sea – spacious by American standards and mansion-like for South Korea.

Renting a stand-alone house

As for renting a house, a brief search of sites such as Zillow.com, Trulia.com, and MilitaryByOwner.com presented several options, but not a lot worth considering in D.C. Our budget is about $3,000 per month, the housing allowance we’re due to receive from the Navy.

The properties Zillow and Trulia listed for rent in our budget were mostly in the same part of town in which we’d previously considered purchasing—an area with some mid-price homes available, but uneven school quality. The rental properties were not close to Metrorail stations (Takoma, Petworth, and Fort Totten are the main stations serving the area), and the houses looked like rentals. Plus, we’d still be in a bind scrambling to find high-performing schools for our kids. MilitaryByOwner offered more options in our budget (the standard housing allowance in D.C. for my wife’s rank), but not surprisingly, most houses were clustered near military installations in Virginia or Maryland.

The going rate for three-bedroom stand-alone single-family houses was within our budget, but with little to spare; the $3,000 per month we’d be spending on rent is about the same monthly payment of an anticipated mortgage if we purchased a house. This means we wouldn’t be able to save up to purchase a home, and wouldn’t be terribly close to Metrorail. As a result, we quickly stopped considering renting a house.

Renting an apartment

A recent Zillow.com search yielded 12 three-bedroom apartments in the District with listed rents within our budget. Half of these units were in the same neighborhoods where we’ve so far focused our search for a house to purchase—again, not really what we’d been hoping for because of the distance to Metro. Four more apartments listed for rent were even further away from Metro. The search did turn up one apartment near the Van Ness Metro and another near the Tenleytown Metro, but both had problems: The apartment near Van Ness doesn’t have a washer and dryer in the unit, and the Tenleytown unit claims to carve three bedrooms out of 900 square-feet.

This was not an exhaustive search, and I’m sure more digging would uncover more units. The point is not too many three-bedroom units exist, and the number that are within our budget is even less.

What’s “affordable” housing in the District of Columbia?

The District government has different measures for what constitutes “affordable” housing, but one threshold is to apply the label to housing that is affordable to households earning up to 120 percent of the Area Median Income (AMI). AMI itself is set by the U.S. Department of Housing and Urban Development according to a variety of factors including household size. In our case, the AMI for a family of five in D.C. is $117,290; 120 percent of AMI is $140,748.

Meanwhile, the U.S. Census Bureau considers monthly rent or mortgage payments affordable if they are 30 percent or less than a family’s monthly income. Using an annual income of $140,748 – 120 percent of AMI— as an example, affordable rents or mortgage payments should be $3,518 or less per month, a little more than the military housing allowance set for the District. A 2014 Urban Institute report found that less than half (49%) of renters in D.C. pay less than 30 percent of their household income in rent, and 28 percent pay at least half of their income in rent.[1]

Scores of single- and dual-income families don’t earn close to the Washington region’s AMI, not to mention 120 percent of AMI. Yet as DCFPI has noted, developers often use this 120 percent of AMI figure – the upper range of what is considered affordable – to set the rents in units designated as “affordable” in order to recoup various federal and District subsidies.

My family is lucky – our military housing allowance is an advantage many District families do not enjoy. With the housing allowance factored in, our income is very close to the median income for the area; when I find a full-time job, our family income will undoubtedly be far above the 120 percent of AMI level.

In our case, broadening our search parameters (and shrinking our space requirements) opened more possibilities, including locations in some very desirable neighborhoods. Rents were mostly between $2,500 and $3,000 in Northwest D.C., still in the “affordable” range for our income using the 30 percent threshold. In nearby suburbs such as Bethesda and Arlington, rents were roughly the same range, but buildings tended to have more amenities. The further out we looked, the lower the rents became. However, the transportation trade-off returned: Renting in, say, Rockville would increase our ability to save, but living there would also dramatically increase work commute times.

Don’t forget about interest rates

The problem with renting is after a year or two, our financial situation might be more stable, we might be able to afford a more expensive house—but the cost of borrowing money will have also likely increased.

Interest rates in D.C. are currently hovering close to 4 percent for a 30-year fixed-rate mortgage, according to Bankrate.com. But the trend is already increasing. A year ago, interest rates were about 3.6 in D.C., and the Federal Reserve is very open about planning more rate hikes this year. Some Fed board members have hinted they might push for four rate hikes a year through 2019. Meanwhile, it’s doubtful the price of housing will decrease—even if current federal budget proposals to slash government employment are realized.

Basically, renting now seems to be simply putting off a purchase that will only become more expensive with time. We faced this scenario before and still feel burned.

Our experience with D.C.’s rising housing prices

When our first son was born, in 2012, we sold our condo in the Palisades. It was a one bedroom, 550 square-foot unit—great for a single occupant, and comfortable for a newly married couple. Babies, though, come with a lot of baggage, so we moved to an apartment.

At the time, renting made sense for us. After being listed for about four months, we received one offer—an all cash deal, but with a short closing window. We took it knowing we could easily find a two-bedroom to rent and the Navy was likely pulling us away from D.C. Ten months later we moved to Norfolk.

What we didn’t know then was soon after we left, the window was closing for buying houses in our price range west of Rock Creek Park (including in the Palisades), and will likely remain shut for a long time.

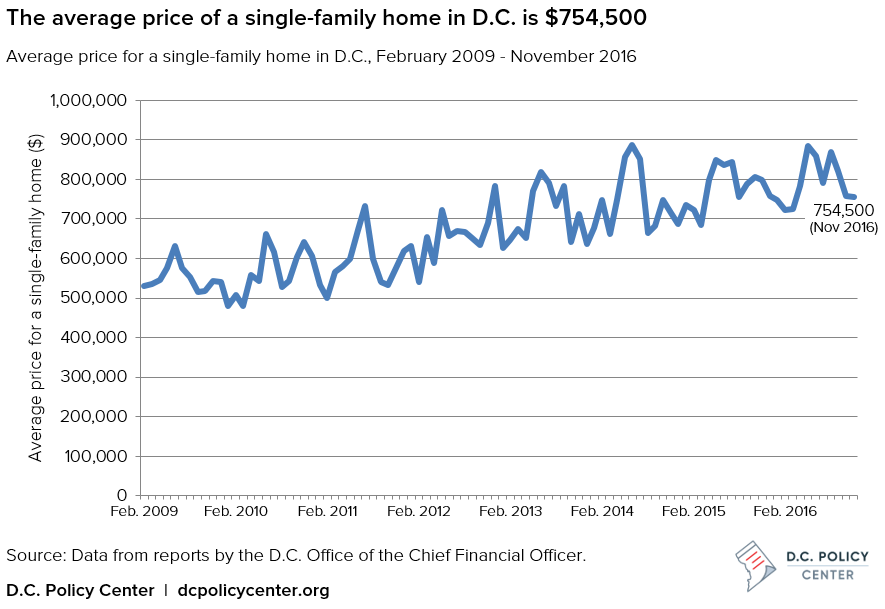

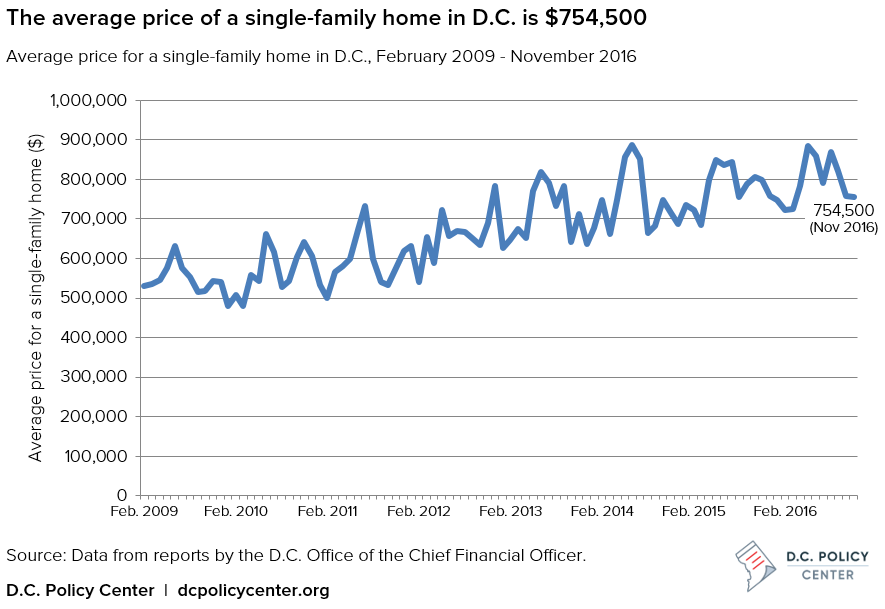

Based on average home sale prices, the last time the average home price in D.C. was even close to the VA and FHA borrowing limit was December 2013, when the average contract was for $637,600, according to sales data collected by the D.C. Office of the Chief Financial Officer. The average price hasn’t been below $600,000 since 2012.

Furthermore, D.C. housing prices have been rising at a steep pace. For the past 25 years, District housing prices grew at nearly double the rate of housing in the entire metro area and the national average, according to a report issued by the D.C. Office of the Chief Financial Officer. Since 1991, D.C. housing prices have increased an average of 5.9 percent per year, compared with an annual growth rate of 3.4 percent for the entire metro area, and a 3.1 percent growth rate nationally.

Recently, for the past decade D.C. housing prices grew much faster than the region or nation. Since 2006 – the previous housing price peak before the national housing crash – D.C. housing prices grew by 37.5 percent while nationally housing prices are essentially back to where they were a decade ago. Meanwhile, housing prices in the Washington metropolitan region dropped after 2006 and remain 16.3 percent blow the high of 2006.

Where this leaves us

So yes, theoretically we could squeeze into a two-bedroom long enough for all of our children to start attending the elementary school of our dreams. We could hope our fortunes improve so we could purchase a house there and remain in that neighborhood.

In the meantime, there’s the downside—cramming five people into a space usually occupied by one or two adults and maybe a child. Three of our five bring outsized collections of clothes, toys, and other assorted gear. My wife has shoes and sundresses; I have books and vinyl records.

After a couple years of discomfort, if we’re lucky, our likely future would entail a house search marked by discouragingly high-priced homes, higher mortgage costs, chancing the D.C. school lottery process, while still considering life across the D.C. line in Maryland—basically the same place we’re at now, only more expensive.

This is the fourth part in a series chronicling the author’s family’s move back to D.C. Previously: Part 1; Part 2; Part 3.